Roberto Perli, manager of the Federal Reserve’s System Open Market Account (SOMA), spoke before the Money Marketeers of New York University on March 5. He discussed monetary policy implementation issues related to the process of reducing the size of the Federal Reserve’s balance sheet and the related transition from an abundant to an ample supply of reserves.

Perli began with an assessment of reserve conditions, noting reserves are still abundant, meaning that everyday changes in their quantity do not affect the interest rate that banks pay to borrow reserves overnight, i.e., the federal funds rate. This can be seen in estimates of the responsiveness of the federal funds rate to reserve levels, which are currently around zero, as well as other indicators of reserve conditions.

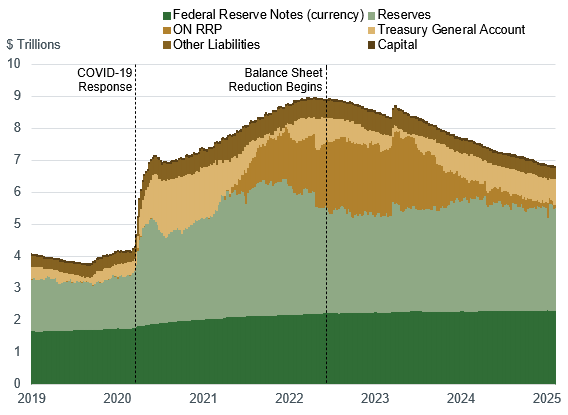

The Federal Reserve has been reducing the size of its balance sheet for almost three years, but so far this has not resulted in any material reduction in the level of reserves, since another Federal Reserve liability—the balances that counterparties place in the overnight reverse repo facility (ON RRP)—has instead fallen (see below chart). The ON RRP is part of the Federal Reserve’s toolkit for ensuring good control of the federal funds rate, and in particular it helps to prevent the federal funds rate from falling below the bottom of the Federal Open Market Committee’s (FOMC’s) target range. Once ON RRP usage approaches zero, further reductions in the size of the Federal Reserve’s balance sheet will have to be accompanied by other Federal Reserve liabilities shrinking, which over the medium term likely means reserves.

Federal Reserve Liabilities

Perli then discussed how dynamics related to the recently reinstated federal debt limit could affect the Federal Reserve’s balance sheet and reserve levels. While Congress deliberates on the debt limit, the U.S. Treasury is likely to draw down its deposit account with the Federal Reserve—the Treasury General Account (TGA). This will mechanically increase other Federal Reserve liabilities. Perli said that based on past experience, he expects at least a portion of this to be reflected in higher reserve levels, with the remainder ending up in the ON RRP.

After the debt limit is addressed, these changes could quickly reverse, as the U.S. Treasury rebuilds the TGA back to the levels it considers appropriate. Perli noted that the longer balance sheet runoff continues while the debt ceiling situation persists, the higher the risk that, upon the resolution of the debt ceiling, reserves could decline to levels that could result in considerable volatility in money markets.

Perli then moved to a discussion of the SOMA portfolio, and how proceeds from maturing securities will be reinvested when the Committee decides it is appropriate to further slow, pause, or eventually cease balance sheet runoff. Perli noted that maturing Treasury securities will likely continue to be rolled over into new securities at auction, consistent with long-standing practice. The FOMC’s principles for balance sheet reduction imply that proceeds from maturing agency debt and mortgage-backed securities are likely to be directed toward Treasury securities via secondary market purchases. The same would be true for eventual securities purchases needed to keep pace with demand for Federal Reserve liabilities, which tends to grow over time as the economy expands.

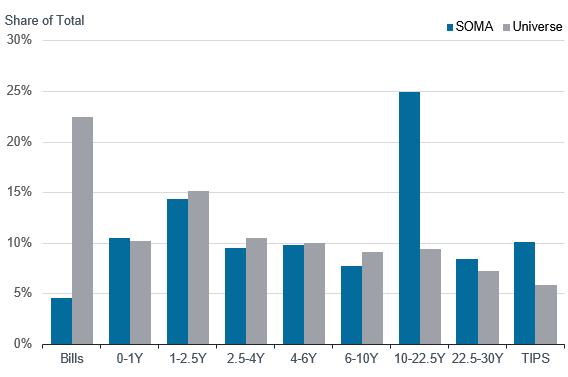

At the January FOMC meeting, many FOMC participants expressed the view that it would be appropriate to structure those secondary market purchases so as to bring the maturity composition of the SOMA Treasury portfolio closer to that of the outstanding stock of Treasury debt, while also minimizing the risk of disruptions to the market. Relative to the Treasury universe, the SOMA Treasury portfolio is underweight Treasury bills and overweight securities with 10 to 22.5 years remaining to maturity (see below chart). Perli noted that allocating secondary market purchases to bills—at a gradual pace, calibrated to avoid having too large of an impact on the market—could bring the portfolio toward a more proportionate composition. However, such a strategy would not lock policymakers into any particular portfolio structure for the longer term.

Maturity Composition of SOMA Treasury Holdings and Treasury Universe

Source: Federal Reserve Bank of New York, U.S. Department of the Treasury

Finally, Perli noted that the Standing Repo Facility (SRF), which allows primary dealers and certain banks to obtain liquidity from the Federal Reserve by pledging high-quality collateral, is another important part of the Fed’s toolkit for ensuring good control of the federal funds rate. It does this by helping to smooth conditions in the repo market, so that higher repo rates do not spill over into upward pressure on the federal funds rate. Given the importance of this objective, the Federal Reserve has been evaluating ways to enhance the effectiveness of the SRF. Perli mentioned specifically the possibility of conducting and settling additional SRF auctions in the morning around certain reporting dates in order to reduce frictions that might discourage use of the facility. He concluded by encouraging counterparties to use the facility when it is economically convenient to do so, as well as to regularly test their ability to use the facility.

Richard Finlay is an advisor in the New York Fed’s Markets Group, on secondment from the Reserve Bank of Australia.

Eric LeSueur is an advisor in the New York Fed’s Markets Group.

Related articles from The Teller Window:

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.