Roberto Perli, manager of the Federal Reserve’s System Open Market Account (SOMA), spoke at the Eighth Short-Term Funding Markets Conference at the Federal Reserve Board in Washington, D.C. on May 9.

He discussed recent developments in U.S. Treasury market liquidity, the importance of the resilience of Treasury funding markets, and steps the Federal Reserve is taking to enhance that resilience by improving the effectiveness of one of its key policy implementation tools, the Standing Repo Facility (SRF).

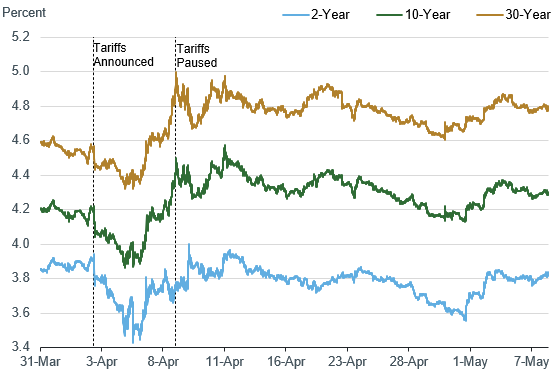

Perli began by reviewing the Treasury market’s reaction to the announcement of significantly higher-than-expected tariffs on April 2. Initially, Treasury yields dropped, in a classic flight-to-safety pattern. After a few days, however, longer-term Treasury yields started to rise sharply—an unusual move in times of substantial volatility across markets. Perli discussed that an unwind of some trades profiting from the difference between longer-term Treasury yields and equivalent-maturity swap rates likely exacerbated the increase in longer-term Treasury yields. Based on extensive market outreach, the unwind of other highly leveraged trades did not play a role.

By April 11, longer-term Treasury yields were about 30 basis points higher than their April 2 level (see first chart below) and interest rate volatility rose significantly (see second chart).

U.S. Treasury Yields

Intraday Trading Range for 10-Year Treasury Yield

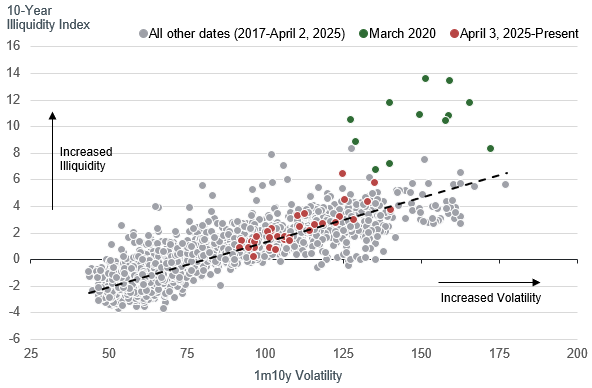

The rise in volatility was associated with a notable deterioration in Treasury market liquidity, meaning that it became more difficult and costly to transact in Treasury securities. Perli noted that this deterioration was real and significant but not exceptional. That is, in sharp contrast to the COVID-related episode in March 2020, the liquidity deterioration was largely commensurate with the increase in interest rate volatility and did not spiral into market dysfunction. In April, a summary illiquidity measure for the 10-year Treasury note remained in line with its historical relation to interest rate volatility (see red dots in below chart), while in March 2020, it became much worse than predicted by volatility alone (see green dots).

10-Year Treasury Illiquidity versus Volatility

Source: Bloomberg L.P., CME Group Inc. (BrokerTec), Staff Calculations

Perli explained that, unlike March 2020, the Treasury cash market continued to function, not only because the shock from the unexpectedly high tariffs seemed less severe than the economic and market disruptions that followed the onset of COVID-19, but also in part because Treasury funding liquidity remained plentiful. Repo market functioning remained orderly, with limited Treasury repo rate variability and no apparent issues with dealer intermediation. The stability of funding liquidity in April was important because it likely prevented further selling pressures in the Treasury cash market, which would have exacerbated market dislocations. In other words, funding liquidity reinforced market liquidity.

Perli then discussed how funding liquidity relates to the Federal Reserve’s policy implementation tools, and he pointed out the importance of the SRF in particular. Funding liquidity is more likely to remain plentiful if money market rates are not too volatile, which, in turn, depends on the availability and efficacy of the Federal Reserve’s tools for ensuring rate control within its ample reserves framework. The SRF is an important part of the Fed’s toolkit that helps support market functioning and dampen upward pressure on money market rates by allowing primary dealers and certain depository institutions to obtain liquidity from the Federal Reserve.

Perli concluded by noting the Federal Reserve’s Open Market Trading Desk (the Desk) recently conducted technical exercises of morning SRF operations with early settlement in addition to the existing afternoon operations with afternoon settlement, in an effort to keep enhancing the SRF’s effectiveness. Following the smooth execution of these exercises and encouraging feedback from outreach to primary dealers, the Desk plans on making early-settlement operations part of the regular SRF daily schedule, starting at some point in the not-too-distant future. Where possible, Federal Reserve staff will continue to look for ways to improve the efficacy of the SRF.

Stefania D’Amico is an advisor in the New York Fed’s Markets Group.

Eric LeSueur is an advisor in the New York Fed’s Markets Group.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.