A core responsibility of the Open Market Trading Desk (the Desk) at the New York Fed is to closely monitor developments in financial markets. The Desk pays particular attention to those markets, such as money markets, in which it conducts open market operations to implement monetary policy at the direction of the Federal Open Market Committee (FOMC). For example, the overnight reverse repurchase agreement (ON RRP) facility and standing repurchase agreement facility (SRF) are executed in the market for repurchase agreements, or repos, to keep the federal funds rate—the FOMC’s policy rate—in its target range.

Historically, money markets, including the repo market, have experienced periods of elevated volatility around quarter-end dates that reflect temporary balance sheet adjustments made by various market participants. The calculation of regulatory and financial reporting metrics on quarter-ends is one driver of those adjustments, and because certain metrics, including specific capital requirements, are more affected by year-end balance sheets, the resulting temporary market pressures can be more pronounced at year-ends. As shown in the chart below, the secured overnight financing rate (SOFR), a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities, tends to be higher on quarter-end dates (shown by the red dots) than the average rate during the rest of the period (shown by the light blue bars).

Change in SOFR on Quarter-end

Source: Federal Reserve Bank of New York

SOFR temporarily increased by about 20 basis points in the days around the September 2024 quarter-end, the largest quarter-end increase in SOFR since 2019. These pressures heightened market participants’ focus on the potential for pressures to emerge in money markets around year-end. For instance, Desk contacts reported that, in late November and early December, repo market participants increased their execution of term and forward-starting transactions spanning year-end to lock in rates at that time, thereby limiting their exposure to potential upward pressure in repo rates on trades executed on the year-end date itself.

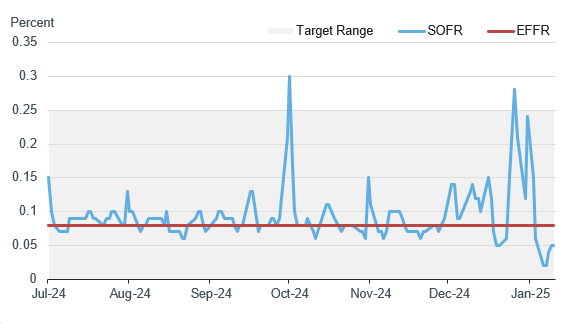

Ultimately, money market conditions were relatively benign around year-end as rates were well-contained. Overnight unsecured rates were stable with the effective federal funds rate (EFFR), a measure of the cost of borrowing overnight in the federal funds market, printing comfortably within the FOMC’s target range, as shown in the chart below. As widely expected, there was upward pressure on SOFR around year-end, but those pressures were smaller than at the September quarter-end and dissipated shortly after. Market commentary broadly pointed to the amount of advance preparation by market participants as helping to limit upward pressure on repo rates at year-end. Given the incentives for some banks to limit the size of their balance sheets at year-end, there were fewer available private-market short-term investments, which, as expected, contributed to a temporary increase in ON RRP facility use around year-end. Finally, year-end conditions in offshore dollar funding markets—such as the FX swaps market—also were benign, and correspondingly, use of the standing U.S. dollar liquidity swap lines was relatively limited.

Overnight Interest Rates (Spread to the Bottom of the Target Range)

Federal Reserve Actions in December

While not a response to year-end money market dynamics, two Fed actions in December may also have influenced market participants’ behavior around year-end. First, at its meeting in mid-December, the FOMC lowered the ON RRP offering rate five basis points more than the reduction to the target range for the federal funds rate. This was a “technical adjustment” meant to return the ON RRP offering rate to its “typical configuration” at the bottom of the target range. This adjustment may have applied additional downward pressure on money market rates, including around year-end.

Second, the Desk announced a SRF “technical exercise,” adding an extra morning SRF auction each business day of the week spanning year-end to the regular daily auctions in the afternoon. The exercise provided Desk staff an opportunity to better understand how the timing of SRF auctions may impact the facility’s ability to dampen upward pressure on repo rates and smooth market functioning. The facility saw only modest “test” use during the week spanning year-end—a total of $4 million in activity across the eight morning and afternoon auctions. This was primarily because private repo rates were largely lower than the SRF rate, making the facility economically unattractive to counterparties. Market commentary suggested that the addition of the morning SRF operations supported smooth market functioning around year-end and helped limit upward pressure on rates on repo trades spanning the year-end. Desk staff continue to analyze data and market commentary related to the technical exercise, and future SRF technical exercises may be considered if Desk staff determine they provide an opportunity to improve the facility’s design.

Where Do Money Markets Stand Following Year-end?

Money market conditions normalized quickly as year-end pressures dissipated. The EFFR continued to print well within the FOMC’s target range and repo spreads returned to levels seen around the middle of December, before year-end effects began to influence market activity. Use of the ON RRP facility declined significantly in the days following the year-end. Currently, overnight repo rates are trading close to the ON RRP offering rate, indicating that the cut to the FOMC’s target range and the technical adjustment to the ON RRP offering rate in December have fully passed through to repo markets.

Looking Ahead

Desk staff expect similar dynamics in money markets to play out around quarter-ends going forward. The re-emergence of temporary money market pressures around quarter-ends is unsurprising as the normalization of liquidity conditions progresses and marks a return to market behavior seen during the prior period of balance sheet runoff from 2017 to 2019 and before the expansion of the Fed’s balance sheet in response to the pandemic in 2020. Desk staff will continue to monitor developments in money markets closely. As balance sheet runoff progresses, the evolution of quarter-end dynamics in money markets may provide additional signals about reserve conditions, complementing the range of other indicators Desk staff are monitoring.

Brian Gowen is a principal in the New York Fed’s Markets Group.

Roberto Perli is the Manager of the System Open Market Account (SOMA) and a senior leader in the New York Fed’s Markets Group.

Julie Remache is the Deputy Manager of the System Open Market Account and a senior leader in the New York Fed’s Markets Group.

Will Riordan is an advisor in the New York Fed’s Markets Group.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.