A recap of insights, analysis and discussions we don’t want you to miss. Each month we compile key highlights from selected publications, events and perspectives to provide you with a deeper look into the work we do at the New York Fed.

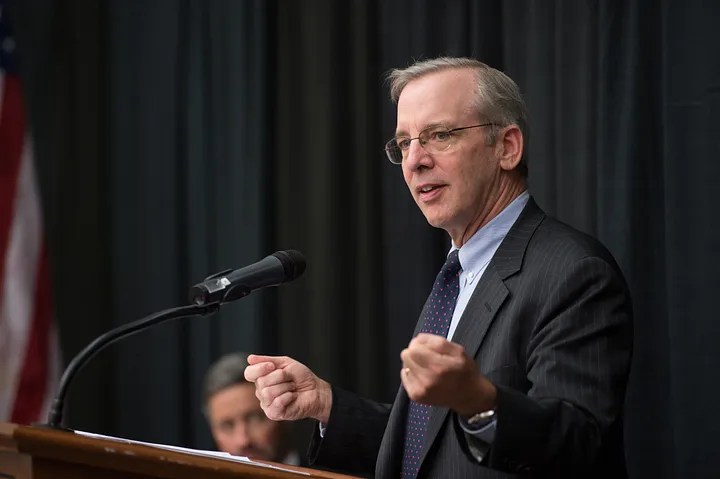

Speech: President Dudley on the U.S.’s Role in Making the Global Financial System More Resilient

President William C. Dudley spoke about measures taken to strengthen the U.S. economy and the importance of doing so for the global financial system in his panel remarks at the annual meeting of the Bank for International Settlements. “Given the role of the United States and the U.S. dollar in the global economy and financial system, the Federal Reserve is mindful of the international effects of its policy,” he said. “That is because those consequences can have important potential spillbacks to the U.S. economy and financial markets.”

Pointing to the Federal Reserve’s recent announcements about balance sheet policies, President Dudley also discussed the importance of “clear communication and transparency around U.S. policy so that expectations can adjust smoothly and be appropriately calibrated to what is likely to occur.”

Interactive: A Closer Look at Our GDP Nowcast

Our nowcast is a short-term forecast that provides real-time estimates of current- and next-quarter GDP growth. We recently launched an interactive of the nowcast to help visualize the impact of incoming data on it. In this blog, three economists who developed the model underlying the GDP nowcast share their thoughts on nowcasting and its role in the policymaking process.

Report: Insights on Consumer Spending, Housing, Payroll in our U.S. Economy in a Snapshot

Consumer spending was up in April with modest but positive indicators in the labor market, according to our latest U.S. Economy in a Snapshot. The monthly report provides updates and graphics on key topics, including Economic Activity, Housing, Business and Government Spending, Labor Market, Inflation and Financial Markets. June’s report also provides a new view of household debt by examining debt balances for student loans, auto loans, credit cards, mortgages and home equity/revolving loans that transition into early (30+ days) and serious (90+ days) delinquency.

About the Report: U.S. Economy in a Snapshot is a monthly presentation designed to give you a quick and accessible look at developments in the economy.

Analysis: How Do Workplace Benefits Affect Decisions to Accept (or Stay in) a Job?

How important are parental leave, flex work and sick leave to selecting an employer or staying in a job? Our economists explore whether workplace benefits become more important than higher salaries and how gender and income level affect employees’ view of benefits.

Analysis: How Have Bank Loans Performed During the Recovery?

Bank loan portfolios look a lot healthier than they did a few years ago, according to the Quarterly Trends for Consolidated U.S. Banking Organizations (QT report). New charts break down commercial real estate and consumer loans. The closer look at commercial real estate loans examines the performance of mortgages backed by several types of “income-producing” commercial properties and of construction loans backed by properties that are still under construction or development. Which real estate loans perform better than others? Our economists explain.

Stay Connected

Sign Up for In Review — our monthly email that highlights the latest work from the New York Fed.

Download our Economic Research Tracker to your iPhone® or iPad®

This article was originally published by the New York Fed on Medium.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.