The New York Fed’s Community Development Team has adopted a new strategy, focusing its energies on three key areas: health, climate, and household financial wellbeing. Our goal is to identify emerging solutions — especially those focused on fostering racial equity and improving life for underserved communities. In this post, we take a closer look at the financial challenges households face and their effect on the wider economy. We also invite you to an event on June 3 at which we will outline our approach to these focus areas.

Based on your current financial situation, how would you pay for an unexpected $400 expense?

That’s a question the Federal Reserve’s Board of Governors regularly asks households around the country, most recently in November 2020.

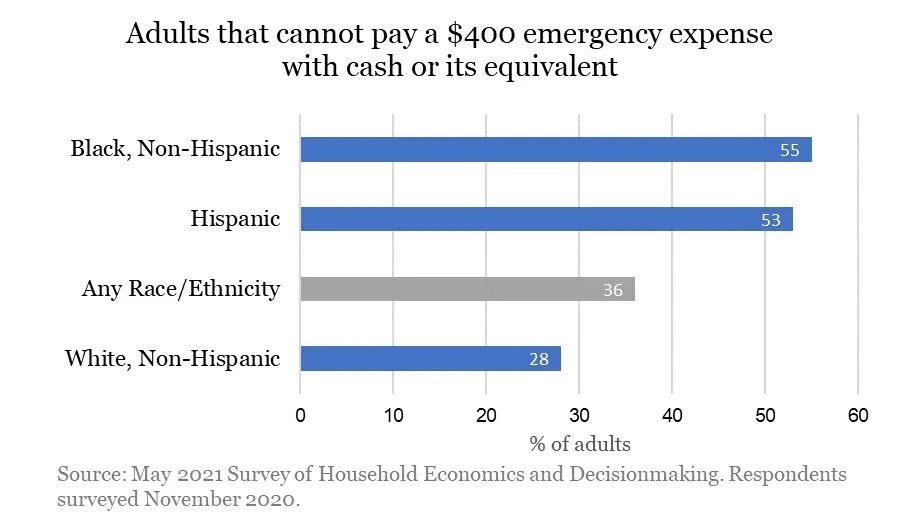

More than a third of adults surveyed could not pay for a $400 emergency expense with cash or its equivalent, according to the latest Survey of Household Economics and Decisionmaking. The survey’s findings were even more pronounced for Black households and Latino households: in each case, about half could not pay cash or a cash equivalent for an unexpected $400 expense.

It isn’t the pandemic that’s driving this challenge. When the same survey was conducted in July 2020, the results showed improvement in this area relative to October 2019 — meaning that prior to the pandemic, even fewer respondents said they could cover an unexpected $400 expense. At the time, Fed economists attributed the improvement to Economic Impact Payments sent as part of federal COVID-19 relief.

As we weigh measures of the overall health of the economy, this indicator — call it the $400 question — is flashing a warning.

It signals that even during October 2019 — a time of low inflation and low unemployment — millions of Americans were one trip to the ER, one car breakdown, or one missed paycheck away from a financial emergency. Of course, ensuring families have $400 in savings won’t eliminate widespread economic insecurity. The $400 question is a symptom of a larger problem.

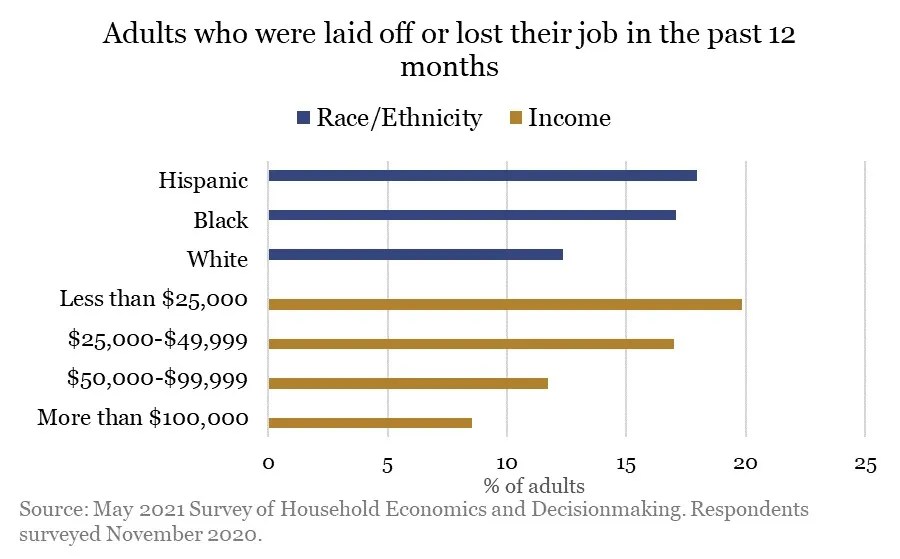

While temporary payments may have helped more people afford an unexpected $400 expense, the pandemic has hit poorer people much harder than wealthier people. For instance, the Survey of Household Economics and Decisionmaking shows that one in five adults making less than $25,000 lost their job in the year prior to being surveyed. By comparison, 9% of those making more than $100,000 were laid off during the same period.

Addressing the $400 question, and the socioeconomic disparities underlying it, is vital for the overall economy. Creating economic opportunity for all would have real, and broad, macroeconomic benefits. Recent research finds that the potential economic gains from broader equity are $3 trillion a year — and growing.

Our team will focus on the $400 question, with the aim of being a source of independent, nonpartisan information, producing research that analyzes and illuminates communities’ needs — research that’s useful for both policymakers and private actors such as foundations, impact investors, and banks that invest in communities under the Community Reinvestment Act.

We’ll also be bringing people together — from grassroots workers to nationally known experts — to discuss their work addressing the $400 question. In fostering these conversations, we hope to elevate ideas that could improve the financial outlook for the people and families who, at the moment, would not be able to manage an unexpected expense.

A few questions this work will seek to address: What programs and policies could be effective in boosting financial resiliency for low- and moderate-income families and individuals? How might a family withstand a financial shock, and recover from it? What can be done to prevent a financial shock in the first place? What structural barriers make Black and Hispanic families more vulnerable to economic disruptions? What potential investments would allow more access to higher education?

We’re also interested in augmenting answers to these questions with actionable solutions that improve economic resiliency. To start, we commissioned a report from the U.S. Impact Investing Alliance on new and emerging sources of capital for community investment. That report will be released June 3.

We also recently hired Otho Kerr to fill a new role. As our unit’s investment relations expert, Otho is charged with connecting big ideas with the funds to make them happen or bring them to scale.

Addressing the $400 question won’t be easy, but the past year has demonstrated that our economy can only thrive when individuals and families have the resources to thrive. That means being able not only to pay monthly expenses, but also to meet an emergency with some cushion of reserves.

The goal, as Fed Chairman Jerome Powell said recently, is “an economy where everyone has the opportunity to contribute to and benefit from prosperity.” That means creating an economy where a $400 bill due for an emergency room visit doesn’t constitute an emergency in its own right.

Virtual event: Capital Quest: Connecting Capital to Communities (June 3)

This article was originally published by the New York Fed on Medium.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.