This is part of an ongoing educational series on nonbank financial institutions.

Mutual funds and exchange-traded funds, or ETFs, are important nonbank financial institutions (NBFIs) in the U.S. financial system. Both are widely accessible investment vehicles that can hold various kinds of assets. Combined, nearly 75 percent of mutual fund and ETF assets are stocks, about 20 percent are bonds, and the rest are commodities and other assets, according to Morningstar data through September. Mutual funds and ETFs are regulated by the Securities and Exchange Commission and are required to disclose information about their investment objectives, structures, and operations on a quarterly basis. This article details how mutual funds and ETFs differ, their recent growth, and their importance to the Federal Reserve’s objectives of monetary policy, prudential supervision, and financial stability. It does not cover money market mutual funds, which are a different type of NBFI.

Differences Between Mutual Funds and ETFs for Investors

While mutual funds and ETFs fill similar roles in investment portfolios, they differ in how investors can buy and sell shares and how they are priced.

Investors purchase mutual fund shares from and sell them back, or “redeem” them, to fund issuers directly or through investment professionals such as brokers. Generally, these are cash transactions. Mutual fund shares are priced once at the end of the trading day, based on the fund’s net asset value (NAV), which is the difference between the fund’s assets and liabilities. This means that all investors pay the same price when transacting in a specific mutual fund on a given day.

In contrast, ETF shares trade on national stock exchanges at market prices and are accessible through brokerage platforms, allowing investors to trade them like stocks. Although ETFs are also valued daily based on their NAV, their share prices often differ from their NAV during the day. ETF shares are generally created and redeemed “in-kind”—meaning the exchange of an equivalent value of an ETF’s shares for its underlying assets. These transactions are done by brokers known as authorized participants, in response to changes in demand.

Size and Growth of Mutual Funds and ETFs

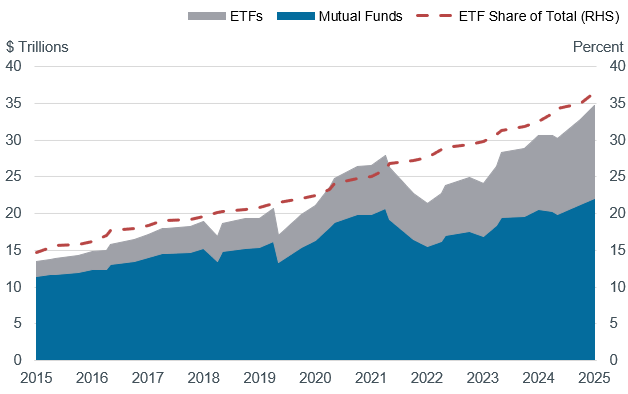

Mutual funds held $22.0 trillion and ETFs held $12.6 trillion in assets under management (AUM), as of September 2025, as seen in the chart below. Combined, mutual fund and ETF assets represent the largest category of NBFIs and are even greater than the assets managed by U.S. banks. Over the past 10 years, ETFs have seen a net inflow of $6.1 trillion while mutual funds have seen a net outflow of $2.4 trillion. ETFs have grown more rapidly in part because they tend to charge lower fees for similar investments and are generally more tax-efficient than mutual funds. They also offer the abilities to trade intraday, use leverage, and sell short. Institutional investors increasingly use ETFs as hedging and portfolio management tools, including to rebalance their portfolios and temporarily invest cash inflows.

Mutual Fund and ETF Assets Under Management

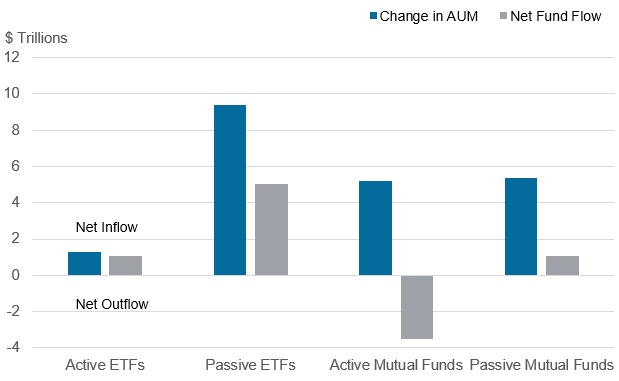

Mutual funds and ETFs can be either “passive” or “active.” A passive fund is designed to achieve the same return as an index, such as the S&P 500, while an active fund aims for a higher return. Passive funds have grown more rapidly than active funds. In fact, over the past decade, passive funds have seen $6.2 trillion of net inflows while active funds have seen $2.5 trillion of net outflows. As seen in the chart below, active funds’ outflows were driven by active mutual funds, while active ETFs actually saw over $1 trillion of net inflows. Market observers credit the significant growth of passive funds relative to active funds to the broad adoption of ETFs and to the tendency of passive funds to cost less than and outperform active funds over the long run.

Mutual Fund and ETF Assets Under Management and Net Fund Flow: 10 Years Ending 3Q 2025

Why Are Mutual Funds and ETFs Important to the Federal Reserve?

Given their growth, mutual funds and ETFs have significant implications for the Fed’s core responsibilities of monetary policy, prudential supervision, and financial stability.

Monetary Policy: The Fed does not implement monetary policy directly through mutual funds or ETFs. However, they are among the largest investors in U.S. financial markets—including U.S. Treasuries, business debt, and equities—through which monetary policy is implemented or transmitted. When the Fed adjusts policy rates or changes the size of its asset holdings, this affects the relative attractiveness of safer assets like government bonds and riskier assets like equities. As a result, investors rebalance their portfolios. This can lead to money shifting between asset classes within mutual funds and ETFs, as well as between the funds and other assets such as bank deposits or money market funds. Additionally, the views of fund managers, investors that own funds, and intermediaries that trade ETFs are important sources for the New York Fed’s market intelligence gathering efforts.

Prudential Supervision: Mutual funds and ETFs have several connections with banks supervised by the Fed. Many funds maintain credit lines with banks for their liquidity needs, although the credit drawn down by funds has historically been small. Additionally, mutual funds often trade securities through broker-dealers that are part of banking organizations supervised by the Fed. For ETFs, bank-affiliated broker-dealers can be key authorized participants that create and redeem large blocks of ETF shares. Banks also can be custodians responsible for safekeeping fund assets and settling trades as well as transfer agents providing record-keeping services for many mutual funds and ETFs.

Financial Stability: Given the amount of assets that mutual funds and ETFs manage and their interconnections across the financial system, they have potential implications for U.S. financial stability. For example, because mutual fund shares can be redeemed on demand, some funds are susceptible to large outflows as they hold assets that may not be easily liquidated in times of stress. Large-scale investor redemptions can lead funds to liquidate positions in distressed markets, disrupting financial stability, as detailed by the Financial Stability Oversight Council. At the same time, the growing preference for passive funds relative to active funds and the growth of ETFs may be altering the composition of financial stability risks in the asset management sector.

Of note, the Fed purchased ETFs in 2020 as part of its efforts to stabilize financial market functioning during the COVID-19 crisis. The Secondary Market Corporate Credit Facility (SMCCF) was established to support credit to employers by providing liquidity to the market for outstanding corporate bonds. The SMCCF purchased eligible corporate bonds and corporate bond ETFs, which the Fed sold in 2021.

In Summary

As the largest category of NBFIs, mutual funds and ETFs together play an increasingly important role in the U.S. financial system. Their growth, size, and connections to other financial institutions have significant implications for the Fed’s core objectives. To stay informed on this and other important trends related to NBFIs, the New York Fed frequently updates a curated selection of research, analysis, and external resources on its website.

Kevin Henry is a principal in the New York Fed’s Markets Group.

© 2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Also in this series:

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.