A recap of insights, analysis and discussions we don’t want you to miss. Each month we compile key highlights from selected publications, events and perspectives to provide you with a deeper look into the work we do at the New York Fed.

Economic Press Briefing: Examining Regional Wage Inequality

President Dudley and a panel of economists held a press briefing on employment trends in our district, with a special focus on wage inequality — the disparity in earnings between workers — a trend that has increased significantly in the U.S. since the early 1980s.

Our economists examined the forces that contributed to wage inequality by pushing up wages for those toward the top, and stifling wage growth for workers toward the middle and bottom of the wage distribution. In his remarks, Dudley noted that “Because of the swift pace of economic change driven by advances in technology and globalization, we ought to step up efforts to help workers build the skills necessary to adapt to change.”

Report: Small Business Startups Are Optimistic, but Have Credit Needs

Startups are 34% of employer small businesses and major drivers of job growth. In 2016, 52% of startup firms applied for financing. How much did they apply for? Who received credit, and who didn’t?

Access to capital is important for both firm formation and growth. The Report on Startup Firms — a follow-up to the Small Business Credit Survey: Report on Employer Firms — provides an in-depth look at the financing and credit experiences of startups with employees. Key findings include:

- 69% of startups had a financing shortfall in 2016. An insufficient credit history and a low credit score topped the reasons why.

- 92% of early stage startups relied on the owner’s personal credit score to obtain financing.

- 27% of nonapplicant startups didn’t apply for financing because they were discouraged — twice as many as mature firms.

About the Report: The Report on Startup Firms, based on results from The Small Business Credit Survey, examines business conditions and the credit environment from the perspective of over 2,000 startups (compared to mature small firms) by assessing their performance and expectations, credit sought and received, lender satisfactions and more.

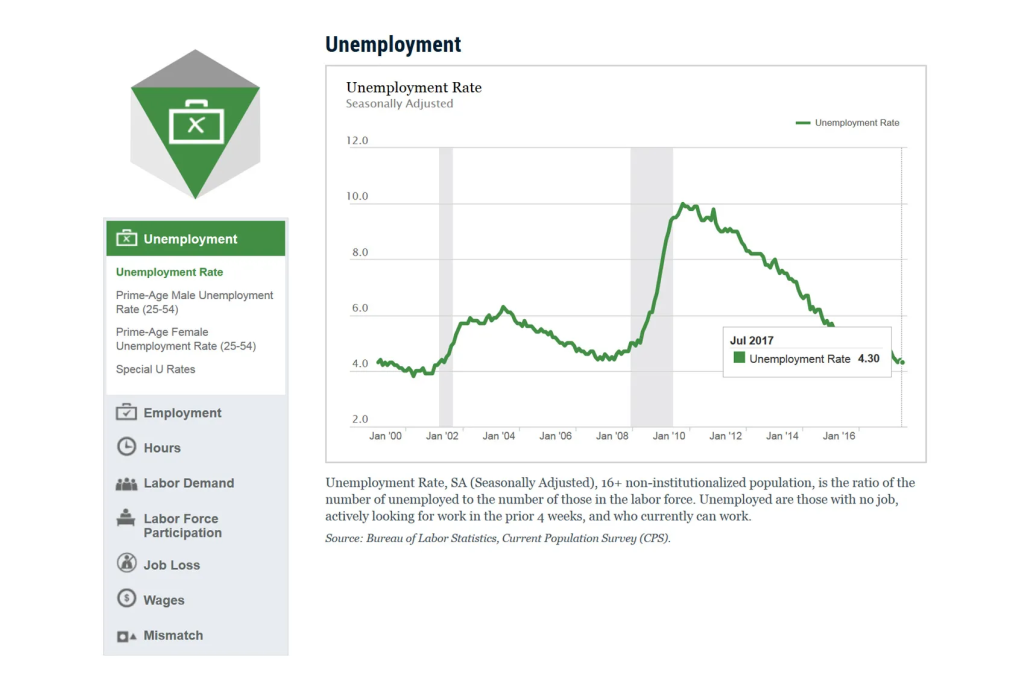

Interactive: Bringing the Labor Market Indicators to Life

Because the workings of the labor market are far more complex than a few indicators, we closely follow important labor market indicators in eight categories — unemployment, employment, hours, labor demand, labor force participation, job loss, wages and mismatch. Our interactive data helps you explore the evolution of these factors over time and provides a complete snapshot of the labor market.

About the Interactive: The monthly release of labor market indicators — primarily generated from data available through the Current Population Survey (CPS), the Current Employment Statistics (CES) program and the Job Openings and Labor Turnover Survey (JOLTS) — helps economists and the public understand national labor market conditions.

Education: How New York Fed Interns Spent Their Summer Vacations

More than 50 outstanding undergraduate and graduate college students earned the opportunity to intern this summer at the New York Fed. Each intern was assigned to a key area or function and learned about the Fed’s responsibilities and operations by collaborating with other analysts, associates and employees. The hands-on learning is enhanced through one-on-one meetings with their manager and mentor and a series of summer learning presentations hosted by senior management.

To help participants learn about our program and career opportunities in public service at the New York Fed, interns shared their experiences through “A Day in the Life of an Intern” series on social media:

Analysis: Exploring Government’s Role in U.S. Mortgage Markets

Nine years after the financial crisis, the U.S. mortgage market has seen few significant reforms. We organized the workshop “The Appropriate Government Role in U.S. Mortgage Markets,” to bring together leaders from academia, government, nonprofits and private companies to explore reforms that should guide the future structure of the U.S. housing finance system.

To examine the U.S. government’s role in mortgage finance, presenters discussed how to promote homeownership and financial stability, including the roles of government corporations (Ginnie Mae) vs. government-sponsored enterprises (Fannie Mae and Freddie Mac) in supporting borrowers with little-to-no down payment and less than stellar credit histories. Presenters also explored the challenges of maintaining affordable housing and attracting private capital to the secondary mortgage market. Other reforms discussed include how policymakers can better assess if programs are working as intended and establishing effective foreclosure prevention programs to manage future market stress.

Additional information, including presentations and insights, is available online.

Report: Household Debt Increases and Credit Card Delinquencies Rise

Total household debt reached $12.84 trillion in the second quarter of 2017, surpassing its previous peak in the first quarter, according our latest quarterly report. There were modest increases in mortgage, auto and credit card debt, no change in student loan debt and a modest decline in balances on home equity lines of credit.

Credit card balance flows into both early and serious delinquencies increased from a year ago — a persistent upward movement not seen since 2009. Our economists provide additional details on transitions into delinquencies and recent developments in the consumer credit card market in an accompanying blog post.

About the Report: The Household Debt and Credit Report offers an updated snapshot of household trends in borrowing and indebtedness, including data about mortgages, student loans, credit cards and auto loans.

Stay Connected

Sign Up for In Review — our monthly email that highlights the latest work from the New York Fed.

Download our Economic Research Tracker to your iPhone® or iPad®

This article was originally published by the New York Fed on Medium.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.