An ample supply of reserves—consistent with the Fed’s “floor system”—and the smooth functioning of funding markets are critical to effectively implement monetary policy. Market disruptions occasionally require the rapid provision of additional liquidity. One way to do this is through open market operations conducted with primary dealers, in which the Fed increases the reserve supply either temporarily or more permanently.

The Fed’s standing liquidity facilities also help maintain ample reserve supply and, in addition to supporting market functioning, are important tools for interest rate control. These facilities include the discount window, standing repo facility (SRF), and international dollar facilities.

The fact that these are standing facilities—that is, consistently available regardless of market conditions—is an important signal that can curb upward rate pressures in funding markets and promote more efficient distribution of liquidity, even without significant or any usage. These facilities also allow for the provision of liquidity to a broader set of market participants.

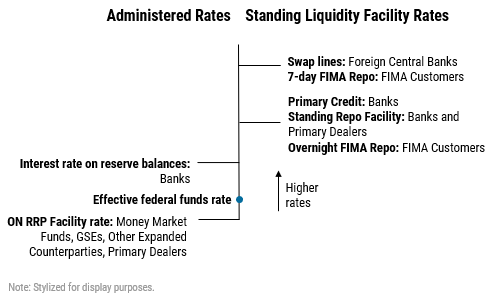

While these facilities vary in their specific terms, they are all available on a consistent basis to supply dollars against eligible collateral. They are designed as backstops rather than primary sources of liquidity, and as such, are priced above generally prevailing market rates (see stylized representation below). In this article, we review these facilities with details on their origins, operations, and functions.

Relative Pricing of Standing Liquidity Facility Rates

Discount Window

The Fed’s discount window dates back to the inception of the Federal Reserve System. There are three programs currently in operation at the discount window: primary credit, secondary credit, and seasonal credit. These programs provide a backup source of liquidity to banks, lending cash against a wide range of eligible collateral. Primary credit is the most commonly used program and currently offers loans to financially sound banks for terms up to 90 days and on a no-questions-asked basis. The interest rate on those loans currently matches the top of the federal funds target range. Secondary credit is available to certain banks that are not eligible for primary credit, and seasonal credit is available to assist small banks in managing seasonal swings in their balance sheets. Institutions borrow from the discount window for a variety reasons, including transitory funding needs in periods of market stress. The discount window is also an important tool for maintaining the federal funds rate within its target range, since it alleviates pressure when market rates would otherwise exceed the top of the target range.

Standing Repo Facility (SRF)

The Fed’s SRF, established in 2021, is designed to avoid instances in which excessive upward pressure on overnight interest rates pushes the federal funds rate above the FOMC’s target range. The SRF represents an expanded and standing version of the Fed’s traditional repo operations used to add reserves.

The SRF offers overnight repos, a form of secured funding, to a range of eligible counterparties, including primary dealers and banks that meet certain criteria. That allows them to borrow from the Fed using U.S Treasuries, agency debt, and agency mortgage-backed securities as collateral. Operations are conducted daily as an auction with a minimum bid rate set by the FOMC (see this FAQ for details). Because the SRF is intended as a backstop tool, the minimum bid rate is set at the top of the target range for the federal funds rate—above the level of interest rates that normally prevail in overnight repo markets, particularly when reserve supply is ample. Given their central role as intermediaries in the repo market, these counterparties can then efficiently distribute that liquidity across the broader financial system.

The Fed’s International Dollar Facilities

The U.S. dollar is used extensively worldwide in trade, investment, and finance. That means a large amount of dollar transactions take place outside of the United States. To facilitate these dollar flows, global dollar funding markets involve both U.S. and non-U.S. participants. The interconnectedness of global markets can quickly transmit both favorable conditions and strains across borders. That’s why the Fed has two complementary dollar liquidity backstops to alleviate global dollar funding strains and prevent spillbacks to the United States.

The Fed’s central bank swap lines with a network of foreign central banks have origins in the early 1960s. They were redeployed in the Global Financial Crisis and became standing in 2013. They can be used to improve liquidity conditions in the U.S. and abroad by providing a select set of foreign central banks with the capacity to deliver dollar funding to institutions in their jurisdictions, including during global systemic shocks. This supports activities that rely on access to U.S. dollar funding, including supplying credit to U.S. borrowers. The current pricing of swap lines reflects their backstop role and is set at the applicable term overnight index swap rate plus a spread, currently at 25 basis points. During periods of stress, the Fed can—and in fact did—establish temporary swap lines with additional foreign central banks, expanding its support to global dollar funding markets.

The Foreign and International Monetary Authorities (FIMA) repo facility, introduced in 2020 and made standing in 2021, allows certain FIMA account holders—which are foreign central banks, international monetary authorities, and some other foreign official institutions—to temporarily exchange U.S. Treasury securities held at the New York Fed for U.S. dollars. The facility provides a source of cash to these account holders without them having to sell their Treasury securities in the open market. Therefore, the facility also supports the smooth functioning of the Treasury market by reducing risks of disorderly sales to generate liquidity. Similarly reflecting its backstop role, pricing is set in line with the SRF for overnight transactions and at the 7-day overnight index swap rate plus a spread, currently at 25 basis points, for transactions with 7-day maturity.

Now that we’ve covered the Fed’s monetary policy implementation framework, the role of its balance sheet, and its standing liquidity facilities, in an accompanying article tomorrow, we’ll share how all of those elements work in practice by examining developments in monetary policy over the last few years.

Patrick Dwyer is a director in the New York Fed’s Markets Group.

Eric LeSueur is an advisor in the New York Fed’s Markets Group.

Fabiola Ravazzolo is an advisor in the New York Fed’s Markets Group.

Will Riordan is an advisor in the New York Fed’s Markets Group.

Josh Younger is an advisor in the New York Fed’s Markets Group.

Also in this series:

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.