This is part of an ongoing educational series on nonbank financial institutions.

Hedge funds are a category of nonbank financial institutions (NBFIs) that play a significant role in the U.S. financial system. Since they transact in a wide range of asset classes and are major counterparties of the largest banks, their activities increasingly affect market liquidity, price discovery, and overall market functioning. In this article, we discuss the role of hedge funds in the U.S. financial system, their growth, and their relevance to the Federal Reserve’s monetary policy, prudential supervision, and financial stability objectives.

What Are Hedge Funds?

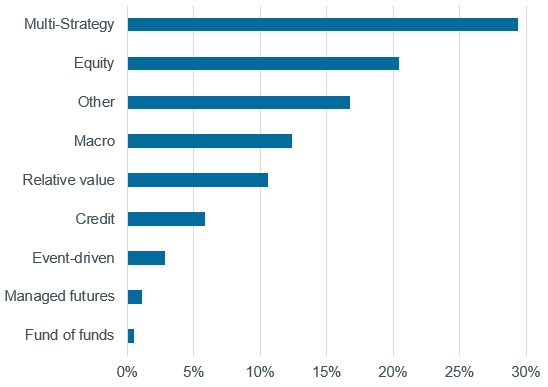

Hedge funds are private investment vehicles that pool capital from accredited investors, such as wealthy individuals and institutional investors. The term “hedge fund” originally referred to a private investment fund that “hedged,” or offset, investments by combining long and short positions in one portfolio. A long position is when an investor owns a security, expecting it to rise in value, while a short position refers to when an investor sells a security they do not own, expecting it to drop in value. Hedge funds use several investment strategies, as defined by the Office of Financial Research’s (OFR) Hedge Fund Monitor and shown in the chart below.

Percent of U.S. Hedge Fund Assets by Investment Strategy

Source: Office of Financial Research Hedge Fund Monitor, as of March 2025

Since hedge funds are not subject to the same regulations as public investment funds, like mutual funds and exchange-traded funds, they have greater flexibility in their operations and investment strategies. In the U.S., hedge funds are subject to registration, disclosure, and other requirements established and/or enforced by the Securities and Exchange Commission (SEC). They may also be subject to Commodities Futures Trading Commission requirements if they use certain derivatives in their trading strategies.

Size and Growth of Hedge Funds

The hedge fund industry dates back to 1949 when Alfred Winslow Jones offered investors a pooled investment vehicle combining long positions expected to outperform the broader market with short positions expected to decrease in price. While hedge funds have long had an investor base of wealthy individuals and families, they have increasingly attracted a broader array of institutional investors, including insurance companies, pension funds, endowments, and sovereign wealth funds. These investors find the funds’ relatively higher risk-adjusted returns more attractive than what many traditional investment offerings provide. As of the fourth quarter of 2024, SEC Private Fund Statistics show that over the last decade, hedge funds’ total gross assets have doubled to $12.1 trillion while their net assets (gross assets less liabilities) have increased one-and-a-half times to $5.3 trillion.

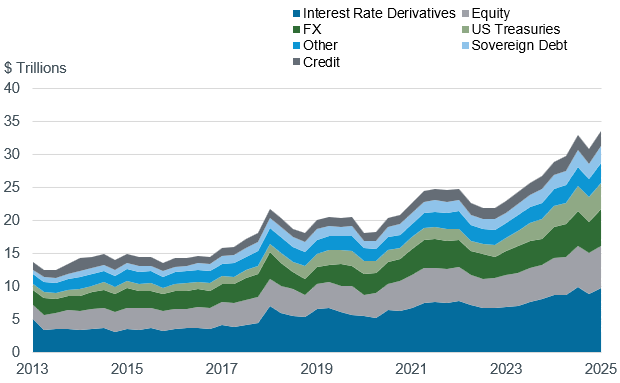

This means hedge funds have a significant market footprint, as measured by gross notional exposures (GNE) —a metric that accounts for both their gross assets and gross derivatives positions. Hedge fund GNE is currently over $33 trillion, up nearly two-and-a-half times since 2013, and spans several asset classes, including sovereign debt, equities, foreign exchange, credit, and interest rate derivatives, as seen in the chart below. Recently, hedge fund GNE growth has been concentrated in U.S. Treasuries and interest rate derivatives. This reflects the prevalence of the Treasury cash-futures basis trade—which is when a fund is long a cash Treasury bond and simultaneously uses a Treasury futures contract to be short a similar bond.

Hedge Fund Gross Notional Exposures by Asset Class

Source: Office of Financial Research Hedge Fund Monitor, as of March 2025

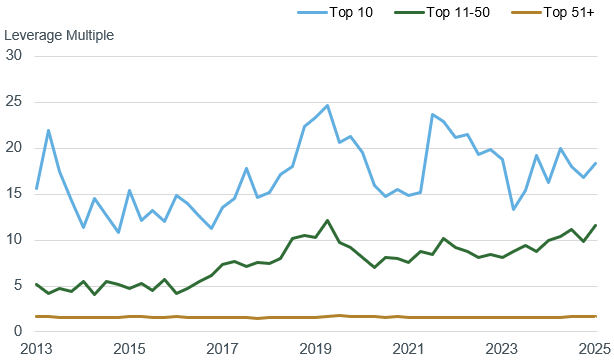

Hedge funds often augment their investment positions using leverage. This means they use securities financing transactions—including margin loans and repurchase agreements, or repos—to supplement the capital provided by their investors. When they use derivatives instead of securities, it’s called “synthetic” leverage. The hedge fund industry overall has a leverage ratio of about two-and-a-half times, as measured by dividing gross assets by net assets. However, leverage is much higher for large funds. As shown below, it exceeds 18 times for the top 10 funds, and about 10 times for the top 11 to 50 funds.

Hedge Fund Leverage by Size Cohort

Source: Office of Financial Research Hedge Fund Monitor, as of March 2025

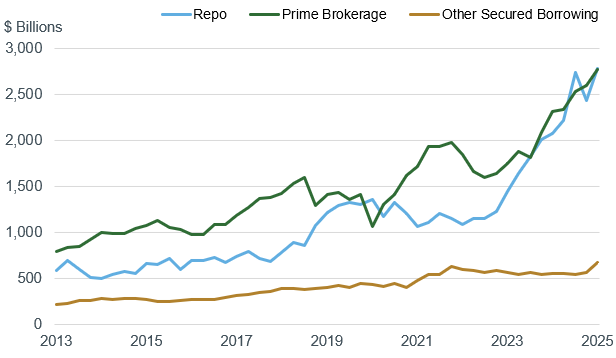

Leverage sources can be divided into three categories:

- prime brokerage, which is largely financing for equity securities;

- repo, which is largely financing for fixed-income securities; and

- other secured borrowing, which largely includes securities lending transactions.

Notably, prime brokerage and repo borrowing have increased rapidly over the past few years, as shown below.

Hedge Fund Borrowing By Source

Source: Office of Financial Research Hedge Fund Monitor, as of March 2025

As highlighted by the OFR Hedge Fund Monitor, hedge funds can provide numerous benefits to the financial system. These include reducing or eliminating mispricing across similar securities and instruments; providing liquidity in periods of calm and stress; adding depth and breadth to capital markets; and enabling risk transfer and diversification by taking on risks that otherwise would be on other financial institutions’ balance sheets. However, hedge funds can also pose risks when they pull back rapidly from certain activities, creating dislocations and disruptions for financial markets, their investors, and their counterparties.

Why Do Hedge Funds Matter for the Federal Reserve?

Hedge funds’ benefits and risks have important implications for the Fed’s functions, including monetary policy, prudential supervision, and financial stability.

Monetary Policy: Hedge funds can rapidly adjust their investment strategies in response to economic, financial, and policy conditions, including changes to or expectations about the stance of monetary policy. Hedge funds are major participants in the Treasury and U.S. dollar repo markets through which monetary policy is implemented. Notably, large hedge funds’ U.S. Treasury exposures have more than tripled from 2018 through 2025, reaching $2.3 trillion in long positions and $1.6 trillion in short exposures.

Hedge funds are also active in asset markets that affect the transmission of monetary policy. As of the first quarter of 2025, net long exposures in credit, foreign exchange, and equities all reached decade-level highs of $1.6 trillion, $3.2 trillion, and $4.1 trillion, respectively. Given this market presence, central banks are closely tracking the potential implications of hedge fund investment activities.

The Fed does this by gathering information on financial market developments, which is called “market intelligence”. The New York Fed’s Open Market Trading Desk (the Desk) collects market intelligence in several ways, including through direct conversations with hedge funds and other market participants, its surveys like the Survey of Market Expectations, and long-running New York Fed advisory and sponsored groups that include members from the hedge fund industry. These perspectives can shed light on how monetary policy is being transmitted into financial markets and ultimately the real economy, through changes in credit conditions, investment activities, and asset allocations.

Prudential Supervision: The largest banks supervised by the Fed, including many global systemically important banks (G-SIBs), have significant interconnections with hedge funds. Through their prime brokerage services, these banks are counterparties of hedge funds, providing them leverage through derivatives and securities financing transactions. As shown below, U.S. G-SIBs have the largest exposures to hedge funds, followed by foreign G-SIBs and then non G-SIBs and nonbanks. Banks also provide broader prime brokerage services—including cash management, custodial services, clearing and settlement, and trading and execution—to hedge funds.

Hedge Fund Borrowing by Counterparty Type

Source: Office of Financial Research Hedge Fund Monitor, as of March 2025

Monitoring these exposures is critical since banks can be significantly affected by counterparty risk. For example, the 2021 default of Archegos Capital Management, a private investment firm that engaged in hedge fund-like investment strategies, caused more than $10 billion in losses at several large U.S. and foreign banks. The Fed also holds certain supervisory authorities over Financial Market Infrastructures, which are key intermediaries for hedge funds to trade and settle securities, derivatives, and other financial contracts.

Financial Stability: As noted above, hedge funds can provide numerous benefits to the financial system. Given their size, participation in key markets, interconnectedness with banks, and use of leverage, hedge funds can also pose or amplify risks to financial stability. This can occur through transmission channels like:

- asset fire sales that can cause or contribute to market disruptions;

- counterparty relationships that can transmit financial distress through financial markets; and

- pullbacks in financial intermediation that can impair market functioning.

Two episodes in which hedge funds affected financial stability include:

- In 1998, distress at the large hedge fund Long Term Capital Management (LTCM) created concerns that its potential default or asset liquidations could disrupt financial markets. In response, the New York Fed convened LTCM’s prime brokers, which agreed to stabilize the fund without disruptive liquidations.

- In 2020, extraordinary liquidations at the onset of the COVID pandemic disrupted the U.S. Treasury market. Analysis by staff at the Federal Reserve Board, New York Fed, and Financial Stability Oversight Council found that hedge funds were a material contributor to the market disruptions.

As part of its regular monitoring of financial stability, the Fed tracks potential vulnerabilities from hedge funds, with a particular focus on financial leverage, and reports its assessment semiannually in its financial stability report.

In Summary

Given their important role in the financial system, hedge funds have significant implications for the Fed’s core responsibilities. With this in mind, the Fed monitors and gathers insights from hedge funds and other major NBFIs to better understand market developments and promote a stable financial system. To stay informed on this and other important trends related to NBFIs, the New York Fed frequently updates a curated selection of research, analysis, and external resources on its website.

Sigurd Ulland is a policy advisor in the New York Fed’s Markets Group.

Also in this series:

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.