A recap of insights, analysis and discussions we don’t want you to miss. Each month we compile key highlights from selected publications, events and perspectives to provide you with a deeper look into the work we do at the New York Fed.

Speeches: President Dudley on Workforce Development & Economic Outlook

During his recent regional visit to Syracuse, President Dudley spoke at Onondaga Community College on the progress and challenges in the regional economy. While explaining that economies of upstate New York have lagged behind the national economy, with job growth running at only half the national pace, Dudley highlighted innovation in some tech hot spots in the region. He said, however, “Taking a broader view, the good jobs being created in today’s economy require more education, training, and ultimately, skill than ever before.”

Earlier in the month, President Dudley also covered the U.S. economic outlook, explaining that fundamentals supporting continued expansion are favorable, with low unemployment, job gains, and rising wages lifting personal income. He noted that even though inflation is below the longer-run objective, it’s “still appropriate to continue to remove monetary policy accommodation gradually.” Dudley also touched on balance sheet normalization.

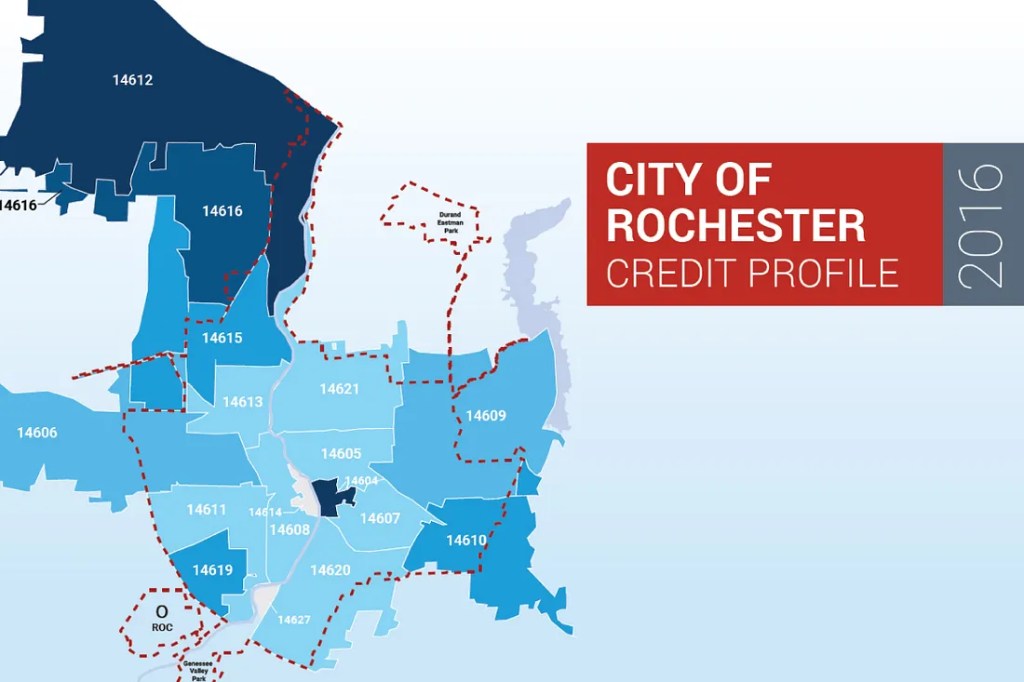

Report: The City of Rochester Credit Profile

With the City of Rochester Credit Profile, we take a closer look at credit access, quality and stress at the neighborhood-level. What’s improving, and where are the gaps? We use micro data analytics to identify and understand the needs of underserved segments within the communities. By using zip codes as a proxy for neighborhoods and measuring various Community Credit indicators, including inclusion and credit stress, we can better understand how access to credit and other factors are impacting the region’s financial security and economic well-being.

Key findings of Rochester’s credit economy include:

- 77% of City of Rochester residents have access to formal credit products, compared to 85% in New York State.

- 52% have a subprime credit score, but this share has been declining over the past decade.

- Fewer individuals have mortgages (compared to New York State and the U.S.), but a larger share were 60+ days delinquent in 2016.

- 29% have a student loan (with a median balance just over $18,000).

About the Report: The City of Rochester Credit Profile is a source of micro data and insights on credit needs in Rochester, including neighborhood breakdowns.

Analysis: The Importance of Paying Interest on Reserve Balances at the Fed

Banks are required to maintain reserve balances with the Federal Reserve, comparable to checking accounts used for deposit liabilities and to settle transactions and interbank payments. Historically, reserves have played an important role in implementing monetary policy. Before the financial crisis, the Fed would adjust the level of reserves to target the federal funds rate, but that carried certain drawbacks, including opportunity costs for the banks, similar to the concept of a “reserve tax.”

In a two-part series, our researchers discuss how, in 2008, the Fed began to pay banks interest on both “required” and “excess” balances and why it’s a more efficient and flexible approach to steer market rates and implement the Fed’s monetary policy in today’s markets.

What Drives Our Research & Statistics Group? Beverly Hirtle Talks Innovation, Data & Diversity

Our Q&A with Research Director Beverly Hirtle takes a look inside the breadth and depth of the Research and Statistics Group’s mission. Advancing critical insights and new theories across a broad range of topics — like bank supervision, capital regulation, stress testing and bank complexity — requires collaboration and innovative thinking across diverse functions and staff. She discusses why the team is essential in today’s post-crisis environment: fostering new modeling and research; devoting more attention to understanding links among financial institutions and markets; and assessing market liquidity, risk, and financial stability.

The blog highlights the relevance of the group’s work for both our district and the nation on compelling issues such as wage inequality, economic activity, and workforce development in a changing economy. Talking about why the Fed is a compelling career path and how this diverse group is more important than ever to achieving the Fed’s broad mission, she said, “My experience in having a tangible impact on real world policy outcomes is not unusual for a New York Fed economist.”

Analysis: The Underlying Inflation Gauge

Looking beyond core inflation measures that typically focus on price and overlook other macroeconomic and financial data, the New York Fed constructed two Underlying Inflation Gauge (UIG) measures to provide an estimate of the trend, or persistent, component of inflation.

- The “prices-only” underlying inflation gauge (UIG) is derived from a large number of disaggregated price series in the consumer price index (CPI).

- The “full data set” measure incorporates additional macroeconomic and financial variables.

With this month’s publication, we launch the UIG webpage for the two measures:

- The “full data set” increased from a revised 2.64% in July to 2.74% in August.

- The “prices-only” measure increased from a revised 2.09% in July to 2.17% in August.

For additional background on strategy and methodology, read our earlier blog and staff report.

Education: The College Fed Challenge Orientation

It’s more than just “back to school” when you’re on one of the 43 college teams participating in the College Fed Challenge. We kicked off this year’s competition with an orientation and a half-day macro boot camp. More than 280 students from our district will compete through preliminary and semi-final rounds through early November, leading to the finals in late November. Learn more about our programs.

Stay Connected

Sign Up for In Review — our monthly email that highlights the latest work from the New York Fed.

Download our Economic Research Tracker to your iPhone® or iPad®

This article was originally published by the New York Fed on Medium.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.