Promoting community development is an important function of the Federal Reserve System. Through a variety of programming and analysis, the New York Fed seeks to help advance economic mobility and resiliency of communities across the Second District. As part of that effort, we encourage capital providers to allocate funding to innovative, measurable, and impactful projects. This year, we’ve taken steps to formalize our work and create a new team in the Outreach & Education function focused on this space by launching the Community Development Finance initiative (CoDeFi).

CoDeFi supports the transformation of entire communities in our region by working closely with regional organizations and helping to increase the effectiveness of community development investments. CoDeFi also leverages the Federal Reserve System’s role in overseeing financial institutions’ compliance with the Community Reinvestment Act (CRA). The CRA — which requires banks to lend, invest and offer services to low- and moderate-income communities in the areas where they operate — has historically served as an essential vehicle for channeling resources into community development. Given the New York Fed’s role supervising compliance of the CRA, CoDeFi aims to help qualified CRA activity meet the current needs of communities.

In other words, we want CoDeFi to help community development finance take center stage and lead to meaningful local change.

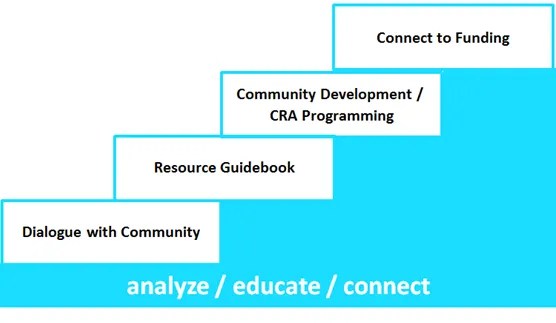

To achieve our mission, the CoDeFi team created a community development finance progression model. We have partnered with our colleagues in the Supervision Group, who lead CRA examinations of financial institutions, to inform and develop the model, which leverages three key New York Fed strengths in community development:

- Analyze — develop independent data-driven analysis on key issues

- Educate — teach community organizations and local actors how to play an active role in community development finance and the CRA

- Connect — convene and encourage collaborations between financial institutions, capital providers, community organizations, social entrepreneurs, academia, foundations and economic development agencies, among others

These themes carry through each stage of our progression model, which include a dialogue with the community, development of a resource guidebook, community development and CRA programming, and connections to funding. See Figure 1 below for how these stages and strengths overlap.

To understand how this model will look in practice, we explain the components of each stage.

Stage 1, Dialogue with Community: The first part of the model requires a dialogue with a specific locality. We determine the target geography in conjunction with our CRA examiners, and regions of focus are based on the calendar of upcoming CRA exams, past examinations and need.

Once we have a target geography, we organize a listening session and conduct a series of interviews on the ground. As an independent convener, the New York Fed brings together senior leaders of the nonprofit, public and private sectors to openly discuss challenges, ongoing projects and prospects for the region. We establish strong relationships and build a comprehensive database of local actors. Most importantly, we develop a deep understanding of the community’s unique needs.

Stage 2, Resource Guidebook: The second phase is to produce a Resource Guidebook about the target geography. The Resource Guidebook is a new analytical product developed by the New York Fed to help inform CRA examiners and anyone looking to make investments in the target locality — including financial institutions fulfilling their CRA requirements — understand the community and its needs. Each Resource Guidebook will be available on the New York Fed’s CRA Portal, including our first one — the Elmira Resource Guidebook — which we published in November 2017.

The Resource Guidebook combines qualitative information from our engagement in Stage 1, quantitative data from public sources, and existing New York Fed tools, like Community Credit and the National Small Business Credit Survey. The guidebook is useful for CRA examiners in particular because their evaluations rank institutions’ effectiveness in meeting communities’ credit needs. The resource guidebook provides a performance context analysis for assessing the quality and responsiveness of CRA activity by financial institutions.

Resource Guidebooks encapsulate our role as conveners and catalysts for economic development in a concise practical instrument. It is an independent, data-driven, and accessible tool to help guide investment in these communities.

Each Resource Guidebook, comprised of three parts, is customized to the specific geography’s priorities. The first part provides a snapshot of local economic and social conditions. The second addresses the most critical community development challenges and opportunities for the area’s low- and moderate-income population. The third offers relevant resources about the specific locality. This section incorporates: 1) a guide for navigating public data sources (on topics including demographics, employment and crime); 2) contact information for community leaders and local stakeholders whose expertise can supplement information offered in the guidebook; and 3) a selection of publicly available reports on the region and topics covered.

Stage 3, Programming: For the next stage of our model, we return to the region for CRA and community development training, in partnership with our CRA examiners. The training aims to increase the effectiveness of community development financing and help guide that capital to the most critical areas of need. We present the Resource Guidebook to the relevant community, encourage conversations between nonprofit organizations, economic development agencies and financial institutions, and educate local leaders on CRA as a vehicle to fund projects. We also provide additional educational materials such as case studies — including our first case study on broadband access and the CRA, available in the CRA Portal.

While our programs strengthen our relationships in the geography and underscore our commitment to working with local community organizations, they also set the stage for the various actors to take their projects forward.

Stage 4, Connect to Funding: The last stage of the CoDeFi progression model connects organizations and agencies looking for funding with financial institutions and other capital providers through Investment Connection. Investment Connection, a program created in 2011 by the Kansas City Fed, has connected nonprofit organizations with approximately $29 million in funding so far. The program leverages the Federal Reserve’s convening capacity by offering nonprofits an inclusive and accessible setting to present CRA-eligible proposals to a number of potential investors. We will bring Investment Connection to the New York Fed’s district in 2018.

Together, the four stages of the CoDeFi progression model will support the community development finance ecosystem of geographies in the New York Fed’s region and provide resources to help increase the economic development work already underway. The model also aims to channel significant investments to economically depressed neighborhoods and identify innovative solutions that respond to their most critical needs in a timely fashion. Ultimately, the progression model helps to develop a shared language between community organizations and capital providers encouraging these two key players to work collaboratively in support of a united goal: community transformation.

As mentioned above, we are excited to say that we have already begun implementing our progression model in several areas. In fact, we are through Stage 3 for Elmira, New York — the Elmira Resource Guidebook was just released. And, the first case study on broadband access and the CRA was developed and has already served as the focus of three programs this year across New York State — in Potsdam, Westchester, and Buffalo. All of our materials can be accessed in the New York Fed’s CRA Portal.

This article was originally published by the New York Fed on Medium.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.