This morning, New York Fed EVP Simon Potter, who heads the Markets Group, spoke at a conference in Paris, France. The remarks, titled “U.S. Monetary Policy Normalization is Proceeding Smoothly,” were delivered at “Exiting Unconventional Monetary Policies,” a conference co-hosted by the Euro 50 Group, CIGI, and the China Finance 40 Forum.

Here are five takeaways from the speech, with quoted passages for context:

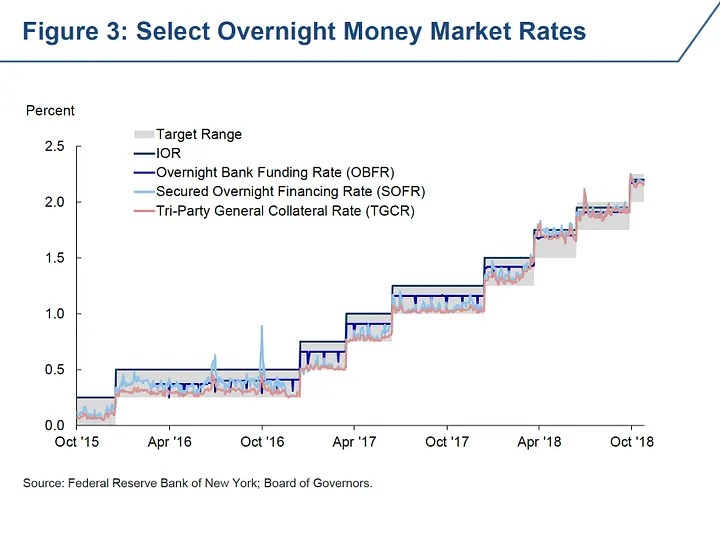

1. The Fed’s process of normalizing monetary policy thus far has been successful: the effective federal funds rate (EFFR), the rate the FOMC targets to manage the level of short-term interest rates, has stayed within the FOMC’s target range, increases in the target range have passed through to other money markets, and the balance sheet has begun to shrink with little impact on financial markets.

[M]onetary control does not stop at the federal funds market: our framework must ensure that the stance of monetary policy is passed through into other money markets. It has also been very successful in this sense. Figure 3 shows a broad selection of secured and unsecured overnight money market rates; it is clear that increases in the target range for the federal funds rate have passed through fully and immediately to the other rates, as expected and intended.

…

Since October 2017, the Federal Reserve’s domestic securities portfolio has decreased by nearly $300 billion to about $4.0 trillion. … The FOMC’s approach to balance sheet normalization — and its transparency and clear communication about the normalization principles and plans prior to its implementation — was designed to mitigate the risk of sharp or outsized asset price reactions to the decline in the portfolio’s size over time. Desk surveys corroborate market commentary describing a relatively limited impact from the reduction in holdings on Treasury yields and MBS spreads thus far.

2. While the ultimate size and makeup of the balance sheet remain uncertain, we do know the key variables that will influence it — and the portfolio may continue to include a sizable portion of agency mortgage-backed securities for a number of years to come.

While the FOMC has articulated how the balance sheet will be reduced, there remains uncertainty about the long-run size and composition of the Federal Reserve’s balance sheet. Importantly, the size and composition will depend on growth in the various non-reserve liabilities, demand for reserve balances, and the future monetary policy implementation framework. The FOMC has not made any decisions about the long-run monetary policy implementation framework; however, the minutes from the July/August FOMC meeting suggest that the Committee will likely resume a discussion of operating frameworks in the near future.

…

[E]ven after the Fed normalizes the size of its balance sheet, the composition of its securities portfolio will not yet be “normal,” as it will not consist primarily of Treasury securities. As you can see from Figure 8, market participants expect that the domestic securities portfolio could contain roughly $700 billion in agency MBS on average in 2025.

3. A broad range of indicators suggests that reserves have not yet reached a level at which they should be considered scarce.

As the portfolio shrinks and the level of reserve balances declines, how will we know if we are transitioning from an environment characterized by abundant reserves to one characterized by scarce reserves? … At high levels of reserves, the responsiveness of rates to changes in reserve levels is fairly low, and the demand curve is said to be “flat.” As excess reserve levels decline, the responsiveness of rates increases. At low levels of excess reserves, the overnight rate responds sharply to small adjustments in the level of reserves, and the demand curve is considered “steep.” Despite some of the recent upward moves in overnight rates, I don’t believe we’ve reached the “steep” portion of the demand curve, where aggregate reserves are scarce.

…

Recent experience supports my belief that we are not at the “steep” portion of the demand curve and aggregate reserve scarcity. … It seems highly likely that we are still on the “flat” part of the curve, where rates move little in response to shifts in reserves. However, it is still possible that the decline in reserves might be putting some upward pressure on rates. Even in the “flat” part, the slope of the demand curve, while small, might be nonzero.

4. The technical tweak made this summer to the rate of interest paid on reserves, which is the primary tool used to implement monetary policy, had the intended effect of helping maintain the EFFR in the FOMC’s target range. Still, further changes in operational settings could be used as market conditions evolve.

Earlier this year, rates paid on the bulk of federal funds trading had ticked up, although they remained within the FOMC’s target range. The uptick in the federal funds rates raised a question as to whether the effective federal funds rate might print above the FOMC’s target range, absent a change in our operational settings. To address the rise in the overnight rate within the range, a technical adjustment to the IOR rate was made at the June FOMC meeting: the IOR rate was raised by 20 basis points while the FOMC raised the target range by 25 basis points. Following that change, all rates paid on federal funds borrowings, as well as in other money markets, rose by about 20 basis points. This made it less likely that the EFFR would be above the target range.

…

Since the June technical adjustment, rates on federal funds transactions have continued to edge higher in the range… [A]nother technical adjustment to the IOR rate, as discussed in the May FOMC meeting minutes, could be used to foster trading in the federal funds market at rates well within the FOMC’s target range.

5. There are reasons to be confident that the Fed’s tools and analytics will ensure a continued smooth process of monetary policy normalization.

We will be monitoring that broad range of indicators to search for evidence that we’re approaching the “steep” slope — and I have confidence that our data and analytics will help us to assess this effectively. We have also conducted a new Federal Reserve survey specifically designed to support our efforts to obtain a high-quality estimate of where aggregate reserve scarcity might occur, and the preliminary survey results strongly support my view that reserve scarcity is some way off. Finally, I am confident that the Federal Reserve has the effective tools and is prepared to take measures as appropriate to ensure that short-term rates remain well-controlled and efficiently transmit the stance of policy into broader financial markets.

…

I remain highly confident that the FOMC’s framework for the normalization of the stance of monetary policy — both in the overnight market and the balance sheet — will continue to proceed smoothly, without unnecessary surprise, disruption, or volatility in financial markets. The monetary policy implementation framework continues to provide the FOMC with excellent control over overnight money market rates, and has proven to be flexible, including through the technical adjustment, in the face of new developments.

This article was originally published by the New York Fed on Medium.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.