Nathaniel Counts, senior vice president for behavioral health innovation at Mental Health America and a clinical assistant professor of psychiatry and behavioral sciences at Albert Einstein College of Medicine, will be a featured speaker at a September 13 event on using capital markets to fund investments in health equity. Ahead of the event, “Creating 21st Century Capital Markets for Better Social Outcomes: Transformative Change Through Debt Financing,” we spoke with him about the idea of funding investments in healthy communities using the savings created by better health outcomes.

Q: What are the challenges that this idea aims to address?

Counts: Despite relatively high levels of spending on health and social services, the U.S. has subpar health outcomes. We need to spend money differently and invest wisely, but necessary new investments are often impossible politically.

Q: How does your proposal work?

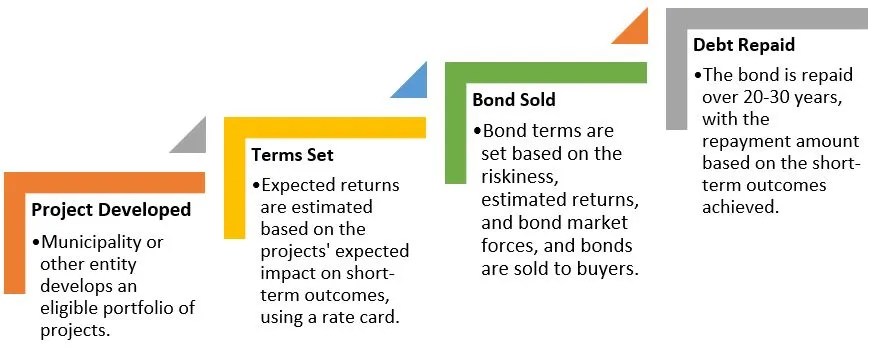

Counts: Under our proposal, a municipality could issue debt to fund beneficial public health initiatives. For instance, it could partner with the state to use debt financing to fund whole-family behavioral health and social supports in a childcare or preschool setting. It could then repay the debt with savings realized by (1) greater tax revenue from a more productive labor force, and (2) decreased healthcare spending as the children in the program grow up healthier. The parameters for eligible projects would be set by the state or federal policymakers. Those parameters should require bonds to be developed with engagement from the community and with a focus on improving long-term health and economic outcomes. In doing so, projects would advance equity and build community wealth.

Q: What are the expected returns?

Counts: States and the federal government would quantify the value of specific short-term outcomes, such as improved rates of kindergarten readiness or reduced incidence of postpartum depression, over the next 20 or 30 years using something called an outcomes rate card. Repayment would proceed over those decades based on the estimated value of improvements in the targeted outcomes.

Q: Tell us about the benefits and the potential impact on the economy.

Counts: This type of bond would offer flexible financing with incentives closely aligned with long-term equity. It would also present greater opportunities for multigenerational and scalable investments. It’s worth noting that we have a lot of questions to answer ahead of widespread adoption of these bonds. For example, what would make them attractive to investors? How would rating agencies evaluate them? Is there a role for philanthropy or social impact investors in helping create them? And what would make them most helpful for states and cities?

The September 13 event is presented by the New York Fed’s Community Development team, which has three areas of focus: health, household financial well-being, and climate change. For more information, see the event page.

Marisa Casellas-Barnes is the community development strategic operations manager in the Communications and Outreach Group at the New York Fed. She focuses on issues related to health, climate, and economic inequality.

This article was originally published by the New York Fed on Medium.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.