In May 2022, the Federal Reserve (Fed) announced that the process to reduce the size of its balance sheet would begin on June 1. With that process now underway, this post reviews the initial months of runoff. We also highlight publicly available resources that provide data to monitor the ongoing runoff of the Federal Reserve System Open Market Account (SOMA), which holds the securities acquired through open market operations.

Consistent with the plans announced in May, the Fed is reducing its balance sheet by redeeming securities up to certain monthly limits, known as caps (redemption is the process of allowing securities to mature without reinvestment). The caps ensure that runoff occurs in a predictable manner over time. For the first three months of runoff from June to August, caps allowed for runoff of up to $30 billion in Treasury securities and up to $17.5 billion in agency mortgage-backed securities (MBS) and agency debt each month. Starting this month, the caps increase to levels of $60 billion and $35 billion, respectively. In other words, the Fed had been reducing its securities holdings by up to a total of $47.5 billion each month from June through August, and starting in September, the maximum monthly reduction will be $95 billion. The Fed will reinvest any maturing amounts above the monthly caps by reinvesting at auctions for Treasury securities or by purchasing securities in the secondary market in the case of agency MBS.

To understand how runoff will proceed across Treasury and agency MBS holdings, some additional details are useful as context. Indeed, due to some specifics of managing the Fed’s securities holdings, settled holdings data may not always track one-for-one with the runoff trajectory implied by the caps. The next two sections explain how the public can use available data to understand these details.

Treasury Runoff: Larger Holdings and More Certain Timing

The Fed’s SOMA Treasury holdings have a known runoff path since Treasury security maturities follow a defined schedule. Under the redemption caps for Treasury securities, the total amount of maturing SOMA Treasury coupons up to the cap is redeemed without reinvestment. If the sum of all maturing Treasury coupons is less than the cap, the Fed will also redeem maturing Treasury bills up to the cap, as described on the New York Fed’s website.

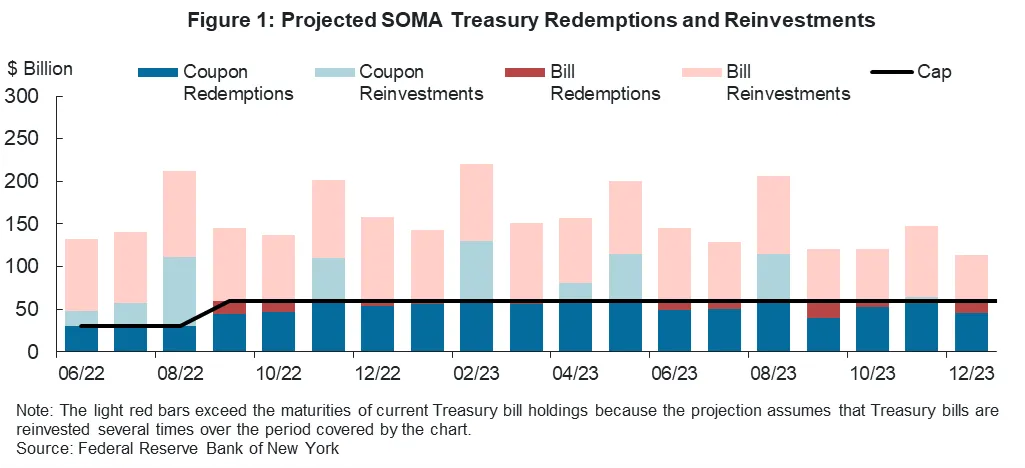

The following chart shows projections of future maturities of Treasury securities held by the Fed along with the monthly cap. The area below the line shows the types of Treasury securities that will be redeemed by the Fed. In most months, coupon securities will make up most of the redemptions (dark blue bars). Periodically, Treasury bills (dark red bars) will also be redeemed when aggregate coupon maturities are less than the cap. Proceeds from maturing Treasury securities (light blue and light red bars) in excess of the cap will continue to be reinvested into new securities at U.S. Treasury auctions.

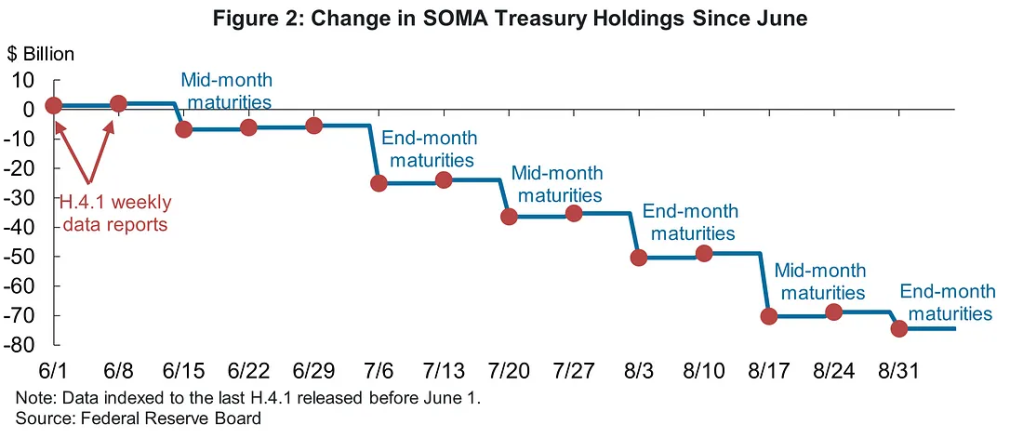

To monitor the ongoing reduction in the Fed’s Treasury holdings, two main sources of data are useful. First, the weekly H.4.1 statistical release reports the face value of the Fed’s total settled holdings of Treasury securities, along with details on bills, notes and bonds, and inflation compensation. Decreases in the Fed’s holdings of Treasury coupon securities take place in the middle and end of every month when Treasury securities mature, as shown in the next figure. These redemptions can be tracked in H.4.1 data, which is updated as of every Wednesday. In months when bills also run off, decreases will also be apparent in reporting periods that include bill maturity dates.

Another factor that can affect the change in the par value of Treasury securities holdings is inflation compensation, which can make tracking changes in the Fed’s securities holdings more complex. Inflation compensation comes from holdings of Treasury inflation-protected securities (TIPS) in the Fed’s portfolio and is reported as a separate line item in the H.4.1 data release. Changes in the Consumer Price Index result in adjustments to the inflation compensation amount on a regular basis. Purchases and maturities of TIPS also result in adjustments to the amount of inflation compensation reported.

In recent months, increases in the Consumer Price Index have resulted in an adjustment higher in the inflation compensation associated with SOMA TIPS holdings, offsetting some of the reduction in the par value of Treasury securities holdings associated with runoff. For example, during June and July, increases in inflation compensation of $9.7 billion account for the difference between the $50.3 billion total decline in total Treasury holdings shown in the data for those months and the $60 billion decline implied by the runoff caps for that period.

In addition to H.4.1 data, the Treasury Department provides details on the amounts that the Fed reinvested at each Treasury auction. This information is available immediately after the auction and includes the amount of Treasury securities awarded to the Fed. This data, along with the detailed maturity schedules of the Fed’s holdings released by the New York Fed, can be used to determine the amount of each specific security that the Fed allowed to mature without reinvestment.

Agency MBS Runoff: A Third of Holdings and Lagged Runoff

The runoff of SOMA agency debt and agency MBS holdings is also subject to redemption caps, with principal payments below the cap to be redeemed without reinvestment. The Fed will reinvest all principal payments over the cap through purchases of securities in the secondary market. Note that for agency MBS we focus on “principal payments” because unlike Treasuries, which have fixed maturity dates, mortgages pay principal each month and these principal payments are not known in advance. This is because mortgage borrowers have the option to prepay their mortgages, for example to refinance an existing mortgage at a lower rate or to pay off a mortgage to move to a new home. The increases in mortgage rates this year have reduced incentives for borrowers to refinance. This has resulted in lower prepayment rates and decreased principal paydowns on Fed agency MBS holdings compared to earlier this year.

The pace of the Fed’s agency MBS runoff going forward is subject to significant uncertainty. Prepayments of mortgages are likely to continue to be driven primarily by the personal motivations of mortgage holders, such as whether to move to a new home, rather than by the ability to refinance at a lower interest rate. New York Fed staff projections indicate that agency MBS monthly principal payments could range between $20 and $30 billion over the next several months, and so would likely not exceed the higher monthly cap that starts this month. In this case, the Fed would cease reinvestments and the reduction of SOMA agency MBS holdings would be less than the $35 billion cap.

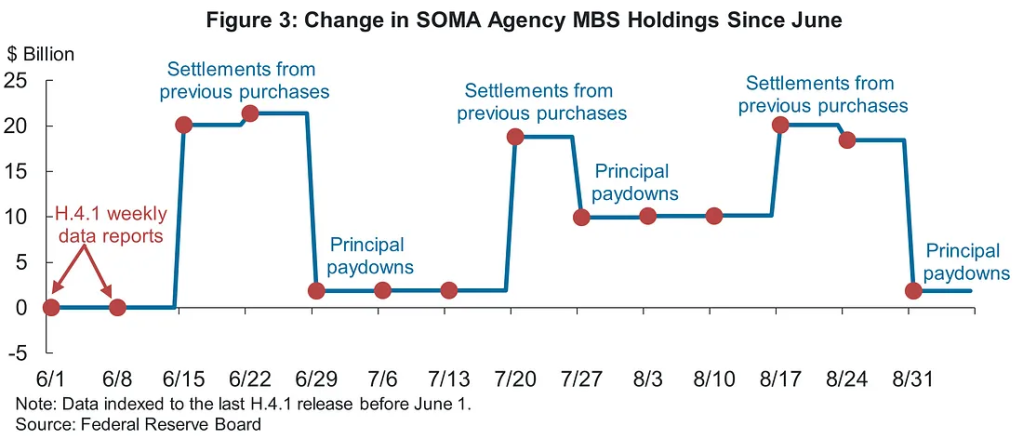

The public can monitor changes in SOMA agency MBS settled holdings on a weekly basis using the H.4.1 statistical release, from which data is displayed in the figure below. Trends in this data illustrate how settled holdings of agency MBS have risen around mid-month when previously purchased agency MBS settle and have fallen near the end of the month when monthly principal paydowns are received. Unlike Treasury securities which are reinvested on the same day that they mature, settlements of agency MBS purchases occur on different dates than the principal payments are received, which can result in variability of MBS holdings over the course of a month .

The figure above also raises a question — why have Fed holdings of agency MBS not decreased since June? The answer involves a number of factors that also were relevant during the previous Fed balance sheet reduction experience from 2017 to 2019.

The agency MBS market and the way the Fed conducts purchases results in lags in the ultimate settlement of purchases of agency MBS. Specifically, when the Fed conducts its agency MBS reinvestment purchases, it uses proceeds from paydowns from the prior month, and the actual purchases occur beginning in the middle of the current month. In other words, reinvestment purchases for a given month are completed in the middle of the following month. In addition, by market convention, agency MBS purchases do not settle until up to a month and a half in the future (settlement is the final exchange of the securities and payments). Combining these two features, there can be as much as a three-month lag from when principal is received to when the agency MBS will show up on the Fed’s balance sheet. Finally, to avoid negatively impacting agency MBS market functioning, the Fed may choose to delay settlement of some agency MBS purchases even further through dollar roll transactions (any such operations are reported on the same day). Table 3 in the H.4.1 release lists “commitments to buy agency MBS,” which represent agency MBS that have been purchased but have not yet settled on the Fed’s balance sheet.

As a result of these dynamics, during the first few months of runoff, holdings were still increasing because of the delayed settlement of purchases that were made in prior months before the runoff began. For example, the $70.1 billion in settlement of agency MBS purchased in previous months plus June reinvestment purchases, offset by the $60.0 billion in proceeds from agency MBS principal paydowns, accounts for the $10.1 billion total rise in settled agency MBS holdings in June and July, versus the $35 billion decline implied by the runoff caps for that period.

As the redemption caps increase in September, we expect that reinvestments will cease. Still, there will be some additional settlement of agency MBS purchased under the previous directive to fully reinvest principal paydowns, which will offset some of the runoff of agency MBS holdings. As runoff proceeds, Fed agency MBS settled holdings are expected to decline. In several months, as previous purchases settle, the declines will begin to more closely track the monthly principal paydown amounts.

The Sum of the Parts

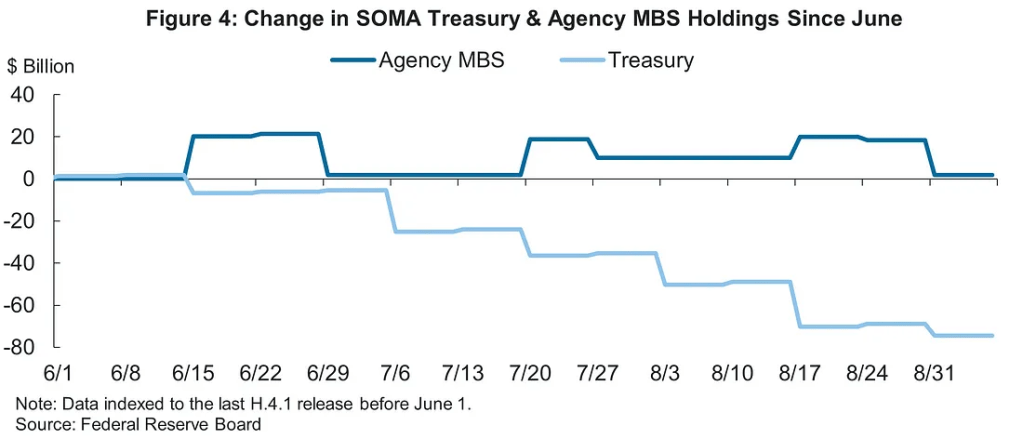

To see the overall runoff in Fed securities holdings, it is helpful to view the combined trends of Treasury and agency MBS holdings together, as shown in the next figure. As discussed in this post, settled holdings in the overall SOMA portfolio are declining, but certain factors mean the declines may not exactly track the cap schedule in real time. Namely, the inflation compensation which partly offsets Treasury securities runoff as well as the features of the agency MBS market and specific way the Fed conducts its operations will all impact the pace of decline.

With the doubling of caps starting this month, the pace of the Fed’s balance sheet runoff is expected to accelerate going forward. The public can track the progress of the Fed’s balance sheet reduction at a granular level in the coming months using the resources highlighted in this post.

Download the data for all figures.

This article was originally published by the New York Fed on Medium.