A recap of insights, analysis and discussions we don’t want you to miss. Each month we compile key highlights from selected publications, events and perspectives to provide you with a deeper look into the work we do at the New York Fed.

Economic Press Briefing: How are Household Borrowing, Student Debt and Homeownership Connected?

President Dudley and a panel of our economists held a press briefing with a three-part presentation covering household borrowing trends, student debt growth, delinquency and repayment and the relationship among homeownership, student debt and educational attainment.

In his remarks, Dudley noted that “Student debt has increased more than fivefold over the past 14 years, with more young adults taking out loans and borrowing larger average amounts.” Our research on college costs and financing shows that access to higher education — along with mounting debt for graduates—has a significant impact on the economy, including homeownership, income mobility and wealth accumulation.

Education: The Economists of Tomorrow Are Students at the New York Fed Today

The High School Fed Challenge brings real-world economics into the classroom, with students playing the role of policymakers by analyzing economic conditions and recommending a course for monetary policy. This year, after months of preparation and days of competition among 57 student teams, the top honors in the High School Fed Challenge, went to:

Stuyvesant High School for the Liberty Street division

Horace Greeley High School for the Maiden Lane division

2017 High School Fed Challenge

About the Fed Challenge: A tradition since 1995, the High School Fed Challenge is a competition among teams of high school students from the Second District. To compete, teams demonstrate their understanding of macroeconomics and monetary policy by delivering a presentation on the economy and fielding a Q&A session with expert judges in the field of economics and monetary policy — our very own New York Fed economists and staff.

Speech: President Dudley on Principles for Financial Regulatory Reform

At a luncheon sponsored by Princeton University’s Griswold Center for Economic Policy Studies, President Dudley discussed the regulatory changes that have made the U.S. financial system “much sounder today than it was on the eve of the financial crisis.” He emphasized the role of capital and liquidity standards as well as resolution mechanisms for “a financial system that is robust and resilient to shocks.”

Dudley outlined areas where reforms may be appropriate to lessen the burdens imposed by post-crisis rules on the financial services sector, as long as “any new changes to laws and regulations be grounded in what we have learned.”

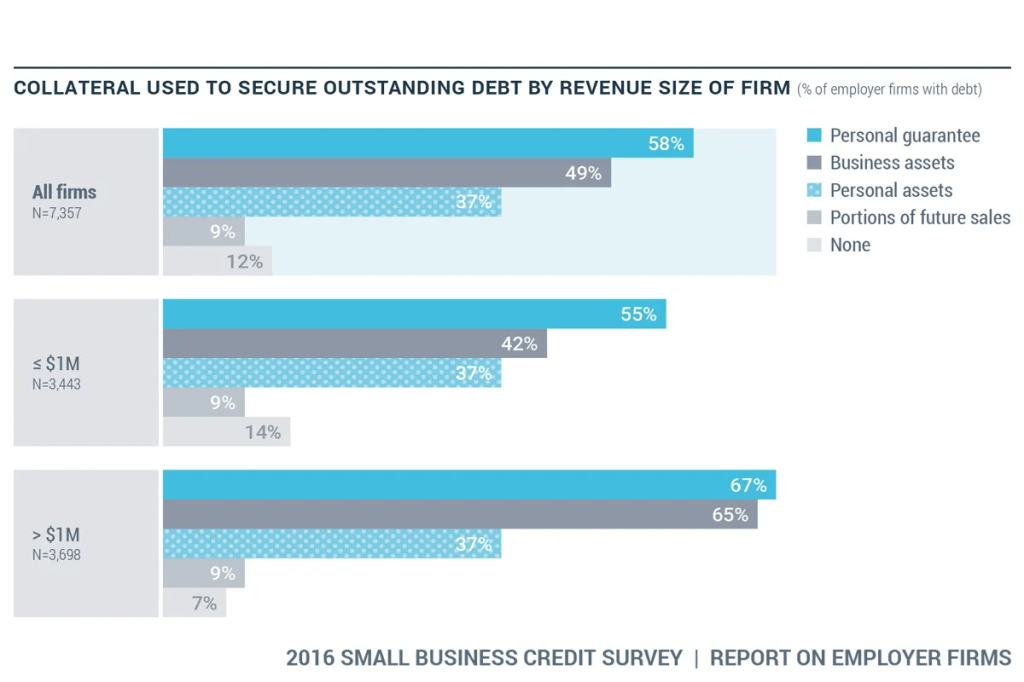

Report: 2016 Small Business Credit Survey: Report on Employer Firms

Key findings from the 2016 report showed that while many employer small businesses were profitable and optimistic in 2016, a significant majority faced financial challenges, experienced funding gaps and relied on personal finances. President Dudley, in a press release explained, “Supporting access to capital and effective financial management empowers small businesses to thrive in today’s evolving economy, so that they can continue driving job growth and innovation.”

About the Report: The Small Business Credit Survey is a national collaboration among the 12 Reserve Banks of the Federal Reserve System to provide policymakers, researchers and service providers with insights and timely information on small business financing needs, decisions and outcomes.

Analysis: Is Chinese Growth Overstated?

The accuracy of China’s official GDP data is a frequent question for market analysts. Many are skeptical of the country’s official numbers; others debate the elements — and their respective weighting — within various indices. Our economists use satellite images of nighttime lights in China to determine whether the country’s growth is overstated.

Education: A Fresh Look at Economics (in a Comic Book, No Less)

The people of Novus, on a planet far, far away, experience many of the same challenges we do on Earth. Our educational comic book, “Once Upon a Dime,” takes a lighthearted, colorful approach to learning and teaching economics. Readers of all ages can identify with the citizens of Novus as they deal with basic financial concepts — currency, credit, bartering and banking — and what to do when their economy suddenly becomes more complex.

Stay Connected

Sign Up for In Review — our monthly email that highlights the latest work from the New York Fed.

Download our Economic Research Tracker to your iPhone® or iPad®

This article was originally published by the New York Fed on Medium.

The views expressed in this article are those of the contributing authors and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.