Enhancing Community Development Investments in Puerto Rico

When communities are affected by natural disasters, banks can play a critical role in the recovery thanks in part to the Community Reinvestment Act (CRA), a regulatory framework that requires financial institutions to lend, invest, and offer services to low-and moderate-income communities in which they operate. Banks can help stabilize and revitalize neighborhoods, promote economic and small-business development, repair deteriorating infrastructure, and create long-term employment opportunities for all.

CDFIs: Catalysts for Equitable Growth

Adrian Franco, the New York Fed’s director of community development finance, delivered a keynote address at the annual conference of the New York State CDFI Coalition in Albany, New York, on May 7. In his remarks, which are published below, he emphasizes how the New York Fed’s community development initiatives can complement the work of community development financial institutions (CDFIs) in promoting equitable growth, and he calls on members of the industry to complete the Federal Reserve’s 2019 CDFI Survey. The survey, which closes on May 31, assesses the condition of CDFIs in the United States in terms of capitalization, financial products, development services, and demand and capacity; it is available here.

Key Takeaways from President Williams’s Speech: Fulfilling Our Economic Potential

On Thursday, April 11, New York Fed President John Williams spoke at the annual conference of the Association for Neighborhood & Housing Development. He discussed the challenges of inequitable growth and his vision for the New York Fed’s community development work.

Investing in America’s Workforce: Update on Regional and National Efforts

Since the release of the three-volume book Investing in America’s Workforce: Improving Outcomes for Workers and Employers last year, the Federal Reserve System and its community and business partners have continued to engage communities and workforce stakeholders on the research and promising practices highlighted in the publication. (For a refresh of the main topics the book covers, see this post from Carl E. Van Horn, Distinguished Professor of Public Policy and Director of John J. Heldrich Center for Workforce Development at Rutgers University.)

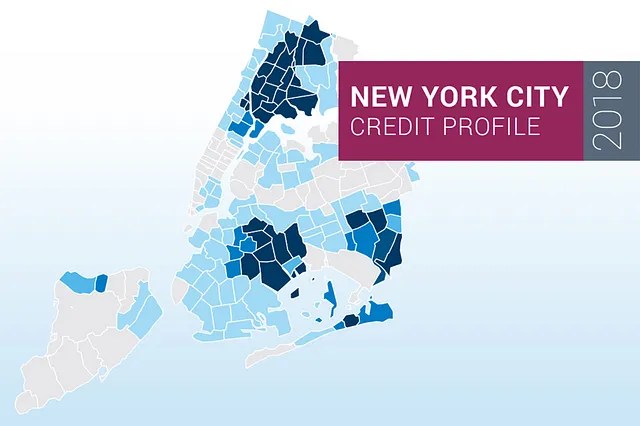

In Bustling New York, Credit Gaps Exist in Many Neighborhoods

New York City has one of the weakest credit inclusion rates in the nation, according to a recent New York Fed report. Data in our New York City Credit Profile show that 22.2% of city residents were not included in the credit economy as of the fourth quarter of 2017. That means over 1.5 million adults were without a credit file or a credit score and without ready access to mainstream financial lenders.

Investing in America’s Workforce: Improving Outcomes for Workers and Employers

Continuing from a post earlier this year about the Federal Reserve System-led IAW initiative, I am pleased to announce the release of Investing in America’s Workforce: Improving Outcomes for Workers and Employers. As co-editor of the publication, I am excited about the release of this three-volume collection that features the knowledge and experience of workforce and community practitioners, and scholars from around the nation. On Friday, November 9, 2018, the New York Federal Reserve Bank will host and co-sponsor the Investing in America’s Workforce Book Launch Event. Over 100 participants will join me to hear 20 national leaders discuss systemic barriers to employment and the strategies and investments that are helping to overcome those barriers.

Long Island’s Overall Prosperity Masks Credit Access Concerns in Certain Neighborhoods

Earlier this year, the New York Fed released the Long Island Credit Profile, the second in a series of reports examining select geographies in depth using the Community Credit framework and indicators. See our previous post detailing the framework for how to interpret the analytics for practice.

A Case for Inclusive Growth: Resource Guidebook for New Brunswick and Perth Amboy in Middlesex County, NJ

It is increasingly apparent that inclusive growth is an accelerator in achieving the potential of economic growth. There is statistical evidence that inequality inhibits overall productivity, yet it remains a persistent issue for many communities. While this is a global phenomenon, we don’t need to look far to see anecdotal evidence of a widening disparity in the distribution of the benefits of a growing economy.

Opportunity Zones: Moving Toward a Shared Impact Framework

The tax bill passed in 2017 includes a provision creating various benefits for investors that move capital gains into designated low-income census tracts, known as Opportunity Zones, through special investment vehicles known as Opportunity Funds.

Equipped with Data to Empower Small Businesses

Small businesses are critical to the U.S. economy and it’s clear that we must do more to understand their needs and realities. One key factor in the success of small businesses is financing, and that’s where the Small Business Credit Survey (SBCS) comes in. The SBCS is an annual survey of small business owners that focuses on firms with fewer than 500 employees. It’s fielded by all 12 regional banks in the Federal Reserve System and aims to address important information gaps about business capital needs and obstacles.