Establishing Workforce Development as an Investment in Our Economy

Following the Investing in America’s Workforce (IAW) capstone conference in Austin, Texas, we wanted to provide an update on our efforts. As mentioned in our post in September, IAW is a Federal Reserve System-led initiative that seeks to underscore the importance of workforce development as an investment in our national economy.

Transforming Communities: What We Learned

At our December summit on community development finance, Transforming Communities: Driving and Assessing Investment, it became clear that organizations financing community development are at a crossroads.

Transforming Communities: Driving and Assessing Investment

This Tuesday, December 12, the Local Initiatives Support Corporation (LISC) and the New York Fed will convene a summit on community development finance. Transforming Communities: Driving and Assessing Investment will advance critical dialogues around defining how community development finance tools can support under-resourced areas, determining the metrics to assess impact, and identifying opportunities for partnerships. Ahead of the conference, we asked senior leaders Denise Scott from LISC and Eric Belsky from the Federal Reserve Board about their views on these issues — from the perspectives of both the policymaker and the practitioner.

CoDeFi: Our Efforts to Transform Communities

Promoting community development is an important function of the Federal Reserve System. Through a variety of programming and analysis, the New York Fed seeks to help advance economic mobility and resiliency of communities across the Second District. As part of that effort, we encourage capital providers to allocate funding to innovative, measurable, and impactful projects. This year, we’ve taken steps to formalize our work and create a new team in the Outreach & Education function focused on this space by launching the Community Development Finance initiative (CoDeFi).

Credit Access: A Window Into Economic Well‑Being

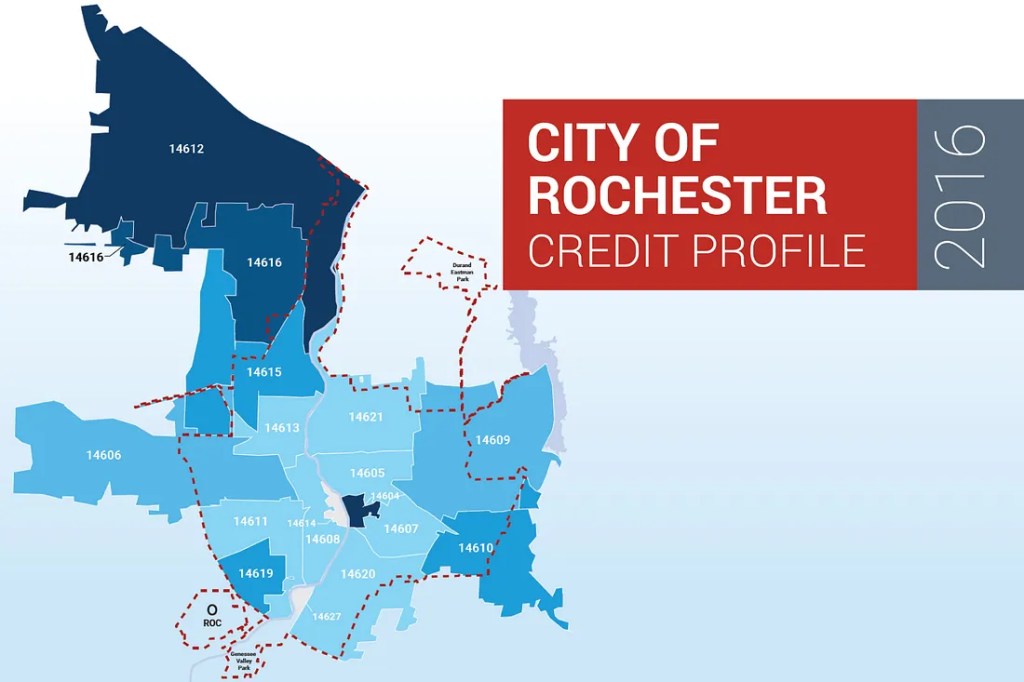

Last week, we released the City of Rochester Credit Profile, a prototype report for assessing economic well-being at the neighborhood level. It’s based on our Community Credit framework, and to understand what’s new and why this is significant, we’ll take a step back and explain the framework first.

On the Job to Promote Workforce Development

We’re midway through our third roadshow of the year, which has given us the opportunity to visit local business, education, and community leaders in Syracuse, Ithaca, and Rochester, New York. This morning, President Dudley delivered remarks on workforce development during our first stop at Onondaga Community College.

Latino‑Owned Small Businesses: Critical to U.S. Economic Success

There’s no question that Latino-owned small businesses are critical to U.S. economic success. After all, Latino entrepreneurs have the highest growth rate of all ethnic groups in the United States, and Latino-owned businesses are responsible for hundreds of billions of dollars in sales annually. Despite these successes, many Latino-owned small businesses lack the financing necessary to grow.

Exploring Online and Offline Informal Work: Findings from the Enterprising and Informal Work Activities (EIWA) Survey

In the fourth quarter of 2015, the Federal Reserve Board conducted a nationally representative survey of adults 18 and older to track online and offline income-generating activities as well as their employment status during the six months prior to the surveys. The Enterprising and Informal Work Activity (EIWA) survey explores why individuals undertake alternative work arrangements by asking questions that capture participant motives and attitudes towards informal offline and online paid work activities.

Why Some Workers Love the Gig Economy

The gig economy remains fairly small — for now. Both RAND and JPMorgan Chase find that only about 0.5 percent of Americans earn labor income through gig platforms. However, this form of work is growing quickly. The JPMorgan analysts also reported that the number of Americans working in the gig economy grew by more than a factor of 50 between 2012 and 2015. The most prominent gig economy company — Uber — has quadrupled in size in less than two years. Uber grew from 160,000 active driver-partners in December 2014 to over 680,000 in September 2016.

Evolution of Work

How we work, where we work, and what we do. The answers to these questions are rapidly evolving and those responsible for supporting the workforce need to understand all facets of this evolution.